How REA Group can raise prices and maintain growth

By Roger Montgomery

This week's Hot Stock is courtesy of Roger Montgomery, chairman and CIO of Montgomery Investment Management.

Key statistics: ASX:REA

Closing share price 18-10-16: $53.120

52-week high: $65.770

52-week low: $44.430

Most recent dividend: 45.5c

Annual dividend yield: 1.53%

Franking: 100%

Realestate.com is the kind of business we like. It's a price maker, not a price taker. We believe it will continue to perform well as the property market matures.

The RBA warned property market investors about "a marked future oversupply in apartments in some geographic areas" in its October half yearly financial stability report.

We believe in a maturing property market, REA Group stands to improve its competitive and financial position. Our thesis on REA Group has been well articulated and in simple terms we expect:

- REA to retain its number one spot in domestic real estate listings

- The number of listings to increase as the property market matures

- The proportion of higher margin "depth" or feature ads to increase as vendors compete more aggressively to highlight their property, and

- The price of depth ads to increase (REA already increased the price of depth ads by 10-15% on July 1).

The combination of the above factors produces a growth-on-growth-on-growth profile for revenues and margins.

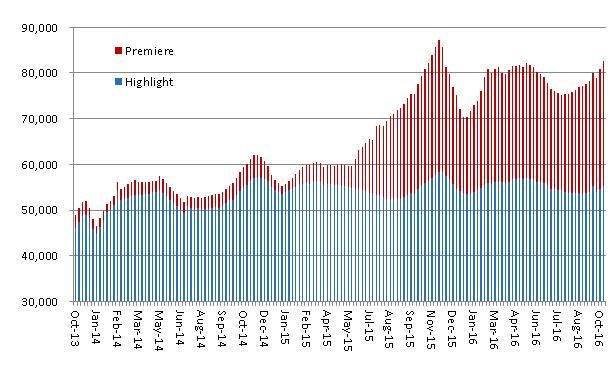

Analyst Ivor Rees, from Morgans, provides a weekly stats update: "Paid depth listings on realestate.com.au for week 42 were 82,510, an increase of 3261 listings (4.1%) on the same week a year ago. Over the past six weeks depth listings were on average 5.0% higher than a year ago. The YTD growth rate in volumes is above that assumed in Morgans' forecasts for depth advertising revenues in FY17."

"More expensive 'premiere' listings totalled 27,245, 13.2% higher than the same week last year. So far the price rise does not appear to have had a material negative impact on volumes."

We favour businesses with competitive advantages and the most valuable of these is the ability to raise prices, in the face of excess supply, without a detrimental impact on unit sales volume.

With over 80 websites in Australia offering vendors the opportunity to list their homes - and many of these offering to do so for free (excess supply) - it's fascinating that REA can raise prices and maintain share and growth.

Source: Montgomery Investment Management

Get stories like this in our newsletters.