Should you buy, hold or sell IDP Education shares?

At Medallion, we are very much drawn towards high-quality growth businesses with a proven track record, particularly those that we believe still have a large runway for growth looking ahead.

One such company is IDP Education (IEL).

This global leader in international education services primarily operates via two business arms - international student placements into universities in English-speaking countries and an English language training and testing division. We expect a burgeoning and cashed-up middle class in developing nations globally to provide strong tailwinds for IEL into the foreseeable future.

International student placements

For more than 50 years, IDP Education has played a major role in international education and during this time, placed more than 400,000 students into universities throughout Australia, the UK, USA, Canada and New Zealand.

The business delivers these placements via a wide geographic network of centres primarily throughout their target market of Asia, working with prospective international students to facilitate placements into a desired course in a suitable university and country.

Particularly noteworthy is the strong relationship and direct shareholding in IEL that is held by around 38 leading Australian Universities, including the likes of UNSW, Sydney, Macquarie, Bond, ANU, Southern Cross, Bond, Monash, ACU, RMIT and Deakin among others.

English Language Training and Testing

The second arm of the company relates to English language testing and teaching. IDP co-owns IELTS (International English Language Testing System), the worlds most trusted English language test.

The test is trusted by over 10,000 organisations globally and is often a requirement for those wishing to work, study or migrate to nations where English is the native language.

In looking at the English language teaching aspect, IEL also operates 11 campuses across South-East Asia. The success in the language side of the business is underpinned by the ongoing global growth in the international education industry and the central role of English as a key global language.

Placements and testing bouncing back post-COVID with strong FY22 results

It's hard to not be impressed by the strong figures in IEL's full-year results delivered in August. While COVID has of course impacted the business in recent times, management has invested heavily with both acquisitions and business improvements such as a digital ramp-up.

The investments, in our view have positioned the business for growth post-COVID which is now being realised. The healthy results delivered for FY22 saw revenues grow 50% to $793 million and Net Profit increase by an impressive 127% to $163 million.

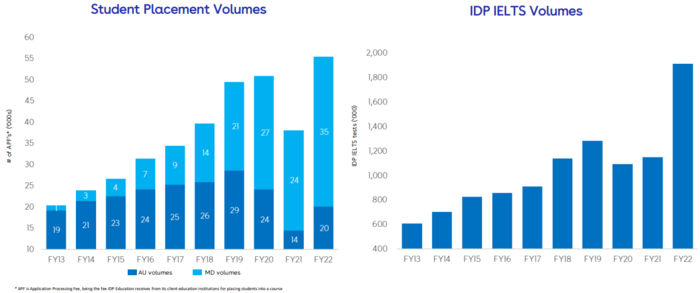

On top of this, a final dividend of 13.5c rounded out a full-year figure of 27c, an approximate 237.5% increase on FY21 and a 38.5% increase on the pre-COVID 2019 full year figure. As shown in the below chart, the post-COVID recovery is well and truly underway with both student placements and testing back to record highs.

Acquisition strengthens student placement business

An up to $83 million acquisition of the UK's dominant student placement provider Intake Education, announced in September, maintains our confidence that IEL remains focused on growing their presence in key growth markets looking ahead. Intake brings a leading player in UK-bound students, with operations throughout Nigeria, Ghana, Kenya, Philippines, Thailand, Taiwan and India.

IEL's interim CEO noted that Intake has the largest and most respected agency in West Africa, making this an acquisition that not only complements existing footprint in Asia but accelerates growth in this emerging African region.

Significant investment and focus on Indian market

With a large and rapidly growing middle class, management has placed a heavy emphasis on continued investment into the high-growth Indian market, a space where we see significant upside potential. In July 2021, IDP acquired 100% of the British Council's Indian IELTS operations for approximately AUD$240 million, meaning IDP took the position as the only IELTS distributor in India. In addition to this, throughout FY22, 12 additional computer-delivered test centres were opened, bringing the total for India to 74 centres.

In addition to the language testing investments, management also bolstered the Indian student placement business by launching 27 new offices through FY22, bringing the total to 67 offices across 60 Indian cities.

Summary

IDP education has not only weathered the COVID-19 storm, but positioned itself to flourish over the years ahead. Management has maintained our confidence through business improvements and strategic acquisitions as they continue to build a powerful global business that can capitalise on macro tailwinds into the future.

Even after delivering record revenues, profits and dividends in FY22, shares are still trading at an approximate 25% discount to 12-month highs and in our view provide an attractive opportunity to accumulate a high-quality growth business during a period of market-wide weakness.

Get stories like this in our newsletters.