Should you buy, hold or sell Ramsay Health Care shares?

By Jun Bei Liu

Ramsay (ASX:RHC) is the largest private hospital company in Australia and one of the leading private hospital operators in Europe and the United Kingdom. Understandably the company has been battered by COVID-19 but there are now clear signs earnings are recovering, particularly in Australia.

The company delivered a solid rebound in revenues and earnings from its domestic operations in the December quarter, after a very weak COVID affected the September quarter in Australia.

The recovery has continued in the new year as the COVID headwinds from patient/doctor infections have fallen and direct COVID costs have dropped. Recent industry feedback indicates operating theatres were full during February and post-pandemic waiting lists should support elevated demand into 2024.

The challenges are staffing and the cost of inflation which are headwinds to the margin recovery story. The workforce shortages have been a challenge worldwide due to post-pandemic fatigue and in Australia's case reduced supply of overseas-trained nurses and doctors. But there are clear signs of improvement with the borders open and economic necessity driving staff back to work.

I am confident the rapid recovery in domestic margins evident in the final months of 2022 will continue in 2023 as the staffing improves and operating theatre activity remains strong. I also expect a similar recovery at Ramsay's UK and European hospitals, but workforce challenges may take longer to improve, and earnings are more dependent on Government funding which is less predictable.

What Ramsay Health Care

Ramsay Health Care is a global hospital group operating nearly 250 hospitals and day surgeries. It provides health services including surgery, psychiatric care, and rehabilitation to both private and public patients. It is the market leader in Australia and a leading provider in the United Kingdom, France, and Scandinavia.

The company began with a single psychiatric hospital in Sydney in 1964 and grew to be the largest domestic hospital group in Australia via acquisitions and internally funded expansion. In 2007 it made its first offshore acquisition with the purchase of private hospitals in the United Kingdom.

This was followed by an acquisition in France in 2010 and again in 2015, establishing a controlling stake in the largest private hospital operator in the country. More recently the group acquired hospitals in Scandinavia through the French business and another hospital business in the United Kingdom call Elysium.

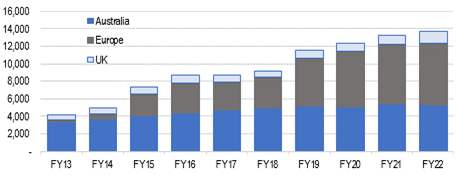

The chart below shows the revenue contribution from the group's operations. While the European operations are the largest by revenue, this division is only 53% owned by Ramsay and carries a significant amount of debt. After adjusting for debt and minority payments the bulk of the group's earnings still come from its Australian business.

Global expansion evident in Ramsay geographically diversified revenues

Strategy

The Ramsay management team's focus is on rebuilding earnings as demand normalises and the staffing challenges moderate.

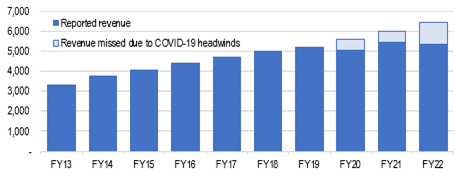

The Australian business alone could generation an additional $1 billion of revenue if demand recovers to the level implied by the historic growth rate. I believe this can be achieved given the group's investment in new capacity.

Australian revenues opportunity from lost COVID years

Ramsay pursued a steady strategy through the pandemic despite the enormous demands placed on it as it supported Governments' health systems across its operations and continued to deal with the usual demand from patients with urgent care needs.

Importantly it continued its investment in expansion projects through the pandemic, particularly in Australia, lifting its operating theatre capacity by more than 10%.

This increased capacity has come online during a period when its competitors have placed almost all their expansion projects on hold. I am excited about the opportunity this presents. The company's market share expanded in 2022 even though overall demand was depressed by the pandemic.

And now I expect to see further gains as the market normalises noting private health membership rose during the pandemic and has so far remained high even as economic conditions have worsened. This tells us people see the value of private health as the public system struggles to deal with growing waiting lists. Combined with increased demand from the aging population I foresee a strong growth in demand for many years to come.

The other key plank of the group's strategy through the pandemic years was workforce, particularly the supply of nurses. The shortage of nursing and to a lesser degree doctors has been apparent for some years but deteriorated significantly due the pandemic.

Ramsay's response has been to expand its internal training programs, particularly its intake of graduate nurses. It has also worked with labour supply partners to rebuild the supply of overseas trained nurses. While the demand for nurses is likely to remain elevated, particularly as local aged care reforms take effect, the tougher economic times should encourage more workers given the relative security of health care work.

The final plank of Ramsay's strategy is price. I am confident it will benefit from good price increases in Australia where it has market power and insurance company profits have been elevated as patient access dropped during the pandemic.

The increased rates should largely offset the inflationary price pressures ensuring a strong margin recovery in Australia through 2023. The situation is less clear cut in Europe and the United Kingdom where prices are largely set by the Government, although the sector wide pressure to lift funding by enough to cover wage increases suggests a decent increase is likely.

Returns

Ramsay has a good track record of delivering strong and improving return equity in the decade leading up to the pandemic. Return on equity was 24% in FY19 but this fell to 7% in FY22 as the pandemic drastically reduced earnings.

Return on total capital employed was a less impressive 12% and had been steady up until FY19 when it began to weaken. I am confident return on equity will recover to previous levels as earnings rebuild.

Recommendation

We recommend buying Ramsay.

Get stories like this in our newsletters.