Should you buy, hold or sell Eureka Group shares?

By Simon Brown

Exposure to the trend of the aging population is going to be a very attractive one in our view, as the population ages due to the pig-in-a-python demographic shift of the baby boomers (1946-64) retiring.

The population growth of the 75-85 age cohort - Eureka Group Holding's key customer - is forecast to grow at 4.2% a year over the next five years. The combination of a swelling cohort of retirees, the increasing trend away from homeownership among older Australians, and a growing proportion of underfunded retirees makes a compelling case for affordable rental housing such as Eureka's.

Eureka is an owner and operator of seniors' rental retirement villages. It is still largely a 'cottage' industry, characterised by some of the highest yields in the property sector. Eureka has evolved as one of the only operators with existing scale and an identifiable niche at the affordable end of the spectrum.

Eureka listed in 2004 as SunnyCove Management, a developer and manager of rental accommodation for senior Australians. The business came under pressure during the global financial crisis because of poor acquisitions and bad debts, forcing a recapitalisation.

This was done alongside the injection of Eureka Care Communities, a management rights business, and the business was renamed Eureka Group.

The company strategy evolved into ownership and management of retirement villages, however once again fell on hard times around 2016 after several acquisitions diverted it away from its core area of competency. Current executive chairman Murray Boyte was drafted in to turn the company around, managing to avoid raising fresh capital and subsequently Eureka shares are 1.5x off their 2019 lows.

What it does

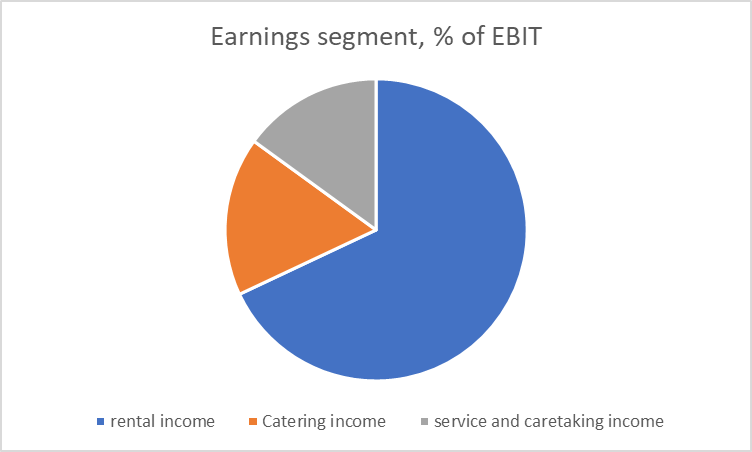

Eureka leases affordable rental accommodation and services to independent seniors, including catering and caretaking.

Its property portfolio consists of 41 traditional retirement villages (2300 total units), the majority of which are owned by the company with the rest managed by third parties under agreement. Its target market is independent seniors who are usually assisted by or dependent upon government pensions and rental assistance.

Rental income is on standard residential lease terms with the resident and there are no deferred management fees. Rents are debited directly the day after pension payments are made. About 95% of Eureka's total revenues are underpinned by the government, making them highly resilient.

Eureka offers catering at most of its locations as an opt-in service. Improving the quality of its meal offerings has been a key part of the turnaround strategy, focusing on customer needs and helping to drive improvement in resident satisfaction and occupancy.

Services such as cleaning and gardening are also additional income streams while caretaking provisions are also offered should residents require them.

Strategy

The current board and management stabilised the business and have turned it around, replacing underperforming village managers, liquidating non-core assets, rebasing rents, and increasing occupancy from 91% to 98%. Its track record speaks for itself, with total shareholder returns of about 150% since the arrival of executive chairman Murray Boyte.

Disciplined capital allocation will result in portfolio improvement through the continued divestment of underperforming or non-core villages, recycling proceeds into new acquisitions, and improvement or expansion of its core assets.

Assets in the portfolio with surplus land provide brownfield expansion opportunities, while regional councils have been keen to engage with Eureka around greenfield development opportunities to cater to the increased accommodation needs of senior populations.

Seniors' rental occupies a niche part of retirement and is ripe to be institutionalised through continued consolidation. Eureka currently is the largest operator with an estimated 14% share of a highly fragmented market.

We see the ability for margin expansion as the company scales. A multi-year program of investment in technology and capability is drawing to a close, whereupon many additional villages can be absorbed with little additional overhead allocation.

Returns

Over the past five years, an investment in Eureka would have returned 14% a year, this compares with an annualised return for the S&P/ASX 200 Index of 2.5%.

Eureka currently pays 38% of its profits out to shareholders as dividends, which results in a current cash dividend yield of 2.1%. While this is low for a property company, we are comfortable for the company to invest in the many growth options available to them. The dividends are not franked given the material tax losses able to be utilised.

ESG considerations

Eureka is critically involved in the health and well-being of some of the most vulnerable members of our community. It aims to empower the well-being and independence of residents in a safe, secure, and active village to create communities. Its 'resident first' philosophy seeks to ensure compassion, respect and trust in village and support office employees.

Village activity programs aim to enhance the resident experience and social connections while connections to local communities contribute to village life.

Commitments to energy conservation include a village solar program which has resulted in more than 85% of residents having a material reduction in power expenses.

The group is trialling waste reduction programs in food service while targeting the replacement of plastic containers by mid-2023.

Recommendation - BUY

We rate Eureka as a strong Buy. Valuation metrics currently sit roughly in line with market PE multiples, while we think the business is more defensive with higher embedded growth. The company's revenue is around 95% backed by government pensions and rent assistance, ensuring favourable inflation protection.

The fragmented nature and lack of institutional capital chasing investment in the seniors rental space afford the company a long runway of consolidation opportunities. The clean and simple structure of revenue, earnings and accounting make it appealing across the retirement living and aged care sector.

Risks include sensitivity to interest rates and debt costs, with any material impairments to property-carrying values introducing balance sheet risk given gearing.

Bottom-up demand for the villages in light of offering quality, management and reputation. Poor practices or resident outcomes can affect occupancy with a catchment area.

However, over the medium term, property has proved an adequate inflation hedge. Eureka has a leading position within its niche and a long runway for growth, in our view. Underlying demand for its product is increasing at an attractive pace, and these structural tailwinds should offer significant benefits for an investment in Eureka Group Holdings.

Get stories like this in our newsletters.