Should you buy, hold or sell shares in Qualitas?

By Simon Brown

Qualitas (ASX:QAL) is a real estate investment manager. It has spent the past 14 years building one of the largest private credit real estate platforms in Australia. This platform has a significant market with limited at-scale competitors and high barriers to entry. The group's success is reflected in its enviable track record of growth and strong profit margins.

After raising a significant amount of capital in an initial public offering (IPO) late last year, Qualitas is well placed to connect the deep pools of sovereign wealth and institutional funds with bespoke investment opportunities in the commercial real estate (CRE) sector. This comes at a time when limited vacancy and new supply is creating strong fundamentals in the multi-dwelling sector.

Qualitas has a highly experienced management team that are strongly aligned with shareholders. Co-founders Andrew Schwartz (group managing director) and Mark Fischer (global head of real estate) retain the key management positions and own a combined 25% of the company.

What it does

Qualitas is a leading Australian alternative real estate investment manager that invests capital on behalf of third-party investors. It currently manages 15 funds in the CRE sector with defined investment strategies combining both private credit (70% of funds under management) and equity products (30%).

Through its funds, the group will partner and invest with high-quality property developers and owners. Each transaction is rigorously assessed by a team of highly experienced real estate professionals.

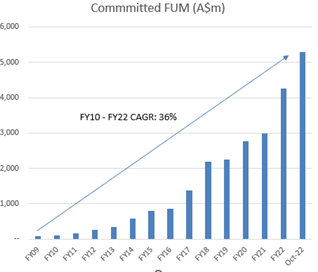

Qualitas has grown funds under management (FUM) from $75 million in 2009 to around $5.3 billion today (October 2022), representing a compound annual average growth of 36% per annum. In recent years fund raising momentum has increased, driving 43% FUM growth in 2022 fiscal year and 24% in the first quarter of 2023 fiscal year alone.

This FUM growth translates directly to revenue growth, via management fees, transaction fees and where applicable, performance fees. As with all funds management businesses, incremental FUM comes through with very high profit margins as the investment team is able to deploy into larger transactions.

The bulk of Qualitas' FUM is deployed into senior debt strategies, which sit in the highest priority position in the capital stack. This implies a lower risk and more defensive investment, which appeals to investors who are seeking stable yield driven returns. The product appeal increases in a rising rate environment as the nominal yield on offer increases.

|

|

Source: Qualitas. As at September 30, 2022.

Strategy

Qualitas has an exposure to a large total addressable market (TAM) which provides a long runway for growth. It estimates that the Australian CRE market opportunity is around A$436 billion, and within this market there are three key lenders: (i) domestic banks, (ii) foreign banks, and (iii) alternative lenders (including QAL).

The domestic banks dominate with approximately 70% market share, however, they have been ceding share for years to foreign banks (with an approximate 20% share) and alternative lenders (approximately 10% share). In Europe and the US alternative lenders command 50 to 60% market share which suggests that Qualitas, which has approximately 1% of the CRE lending market in Australia, should be able to grow significantly before running into any scale issues.

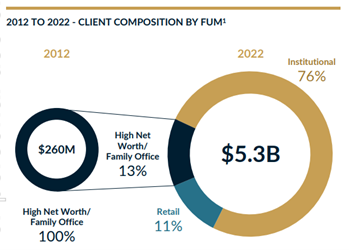

To meet this market opportunity, Qualitas has grown a sophisticated distribution platform. Originally fund-raising efforts targeted high net worth investors and family offices.

However, as Qualitas built a strong track record, this opened the door to winning larger mandates with institutional investors and sovereign wealth funds. A key requirement for these investors is often the ability of the fund manager to commit its own capital to investment strategies (so called "co-investment commitments").

This is what drove Qualitas management to IPO the business in late 2021, raising significant capital for co-investment, a decision that has been justified by significant recent mandate wins, including a $700 million mandate from Abu Dhabi Investment Authority who have flagged the desire to commit a further $1.0 billion over time. Today, over 75% of the FUM comes from institutional investors, and around 50% of capital comes from offshore.

Finally, with a focus on credit products, Qualitas offers a different exposure to most real estate plays on the ASX. Credit investors are positively exposed to higher interest rates, as higher base rates drive up returns on the funds, attracting more investors and also potentially driving performance fees higher.

Returns

Qualitas listed via an initial public offering (IPO) in December 2021 at a price of $2.50. It raised $335 million of new capital in the IPO and it should be noted no existing shareholders sold any shares into the offering.

The capital raised at IPO remains on the balance sheet, Qualitas reported net cash position at 30 June 2022 of $309 million ($1.05 per share) which means that around 40% of the current share price is underwritten by cash on the balance sheet. Over time this cash will be deployed into the group's investment strategies which will add a further earnings stream.

After a relatively subdued share price performance through its first year as a listed entity Qualitas is trading roughly inline with its IPO price. In our view this does not reflect the significant operating momentum that the group has displayed since listing.

ESG considerations

Qualitas' investment committee screens all equity and debt opportunities using the same process relating to environmental, social, and corporate governance (ESG) characteristics. The group exerts influence where it can to influence the ESG characteristics of the assets it invests in. In addition, the group runs a build-to-rent impact fund (QBIF), the first multifamily ESG-linked CRE debt fund in Australia.

The fund has $125 million in committed cornerstone FUM from the clean energy finance corporation (CEFC) and is currently raising additional capital with a target FUM of $1 billion.

Recommendation: buy

We rate Qualitas as a strong buy. The business has an enviable track record of growth through business cycles over more than a decade and we expect that to continue over the years ahead. This growth is under-pinned by some strong secular tailwinds including rising interest rates and a growing private credit sector.

Recent momentum in mandate wins shows that investor appetite for CRE credit products is strong and Qualitas are a leading manager in the space. At current growth rates FUM should double over the next three years which will translate into strong earnings growth.

With a significant portion of the current market capitalisation under-pinned by cash on the balance sheet the valuation of the group is highly appealing.

Get stories like this in our newsletters.