Self-managed super funds are less exposed to virus volatility

By David Thornton

Self-managed superannuation funds are relatively well-placed to ride out the coronavirus mayhem thanks to their greater exposure to cash and low-volatility assets.

Research from Rainmaker Group, which publishes Money magazine, found that a quarter of the self-managed superannuation funds (SMSF) sector's exposure is to cash and 45% to shares. In contrast, other super funds hold on average 10% in cash and 60% in shares.

"This heavy exposure to low risk assets like cash may prove to be fruitful in the current COVID-19 climate as they may be better protected than the average not-for-profit and retail fund," says executive director of research at Rainmaker Information, Alex Dunnin.

"Some super funds' diversified default investment options have fallen 10-15% as a result of the current market conditions."

Despite this, inflows into SMSFs and small Australian Prudential Regulation Authority (APRA) funds fell by 60% over the last two years. They peaked in 2012, when they had 33% of all superannuation funds under management, but that figure has since dropped to 26% - around $750 billion.

The same story applies to the number of SMSF funds. Ten years ago there were net 40,000 SMSFs started each year, while only 12,000 were started in 2019.

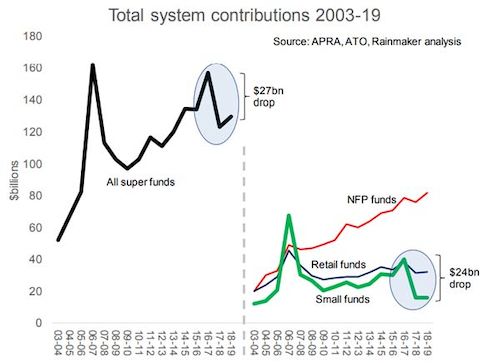

Meanwhile, super contributions have slipped from $157 billion to $130 billion, with SMSFs accounting for 90% of this. The reduction in SMSF contributions appears to have been the introduction of the Transfer Balance Cap (TBC) in 2017.

"The drop in contributions has been so extreme that SMSFs are only marginally ahead of the retail fund segment" says Dunnin, "which fell out of favour with Australians after the global financial crisis."

Get stories like this in our newsletters.