Why you need to take care before taking out a reverse mortgage

By Effie Zahos

How bad are reverse mortgages?

Let me put it another way. How long would it take for your equity to be completely wiped out because you borrowed money against your home?

While there's no denying that in the right circumstances reverse mortgages may be a good solution for cash-strapped, asset-rich retirees, there are many personal and family considerations to take into account before making a decision.

Unlike "forward mortgages", where principal and interest repayments reduce the debt, a reverse mortgage keeps climbing.

They work like this: equity in the home is converted into cash either through the payment of a lump sum, a regular income stream or a combination of both.

How much you borrow comes down to the value of your home and your age. Generally, the older you are the more you can borrow.

Typically, a 60-year-old is able to borrow around 15%-20% of the value of their home and a 70-year-old around 25%-30%. Minimum and maximum amounts apply and they differ among lenders.

No repayments are necessary. Interest and fees are added to the debt and the total is taken out of your estate.

The downside? The compounding effect of interest charges means the debt will usually double every 10 years. At 8%, a $50,000 loan will become about $110,000. This impact could be reduced if your lender allows you to draw down amounts as needed rather than taking a lump sum upfront.

The upside? Property has historically performed at 8%pa (gross) for the past 10 years.

Borrowers who are happy to assume long-term growth of around 3% (LVR of 20%) are likely to see the equity in their property remain the same. Of course, the more you borrow as a percentage of the value of your home, the greater the growth needed.

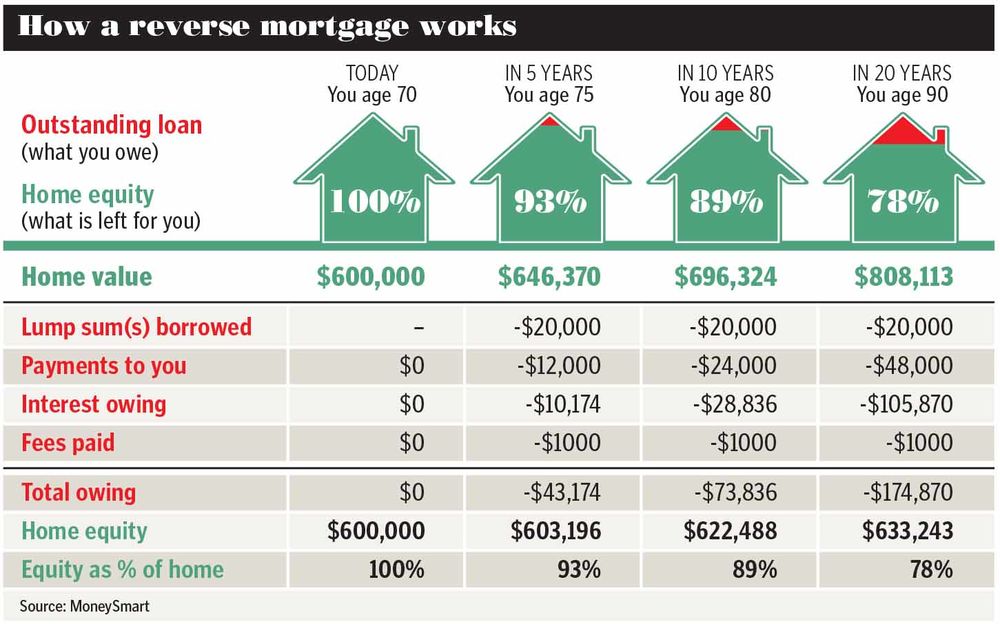

Let's say, for example, you're a 70-year-old woman who owns a home valued at $600,000. You're eligible for the full pension but looking to top it up by $200 a month over the next 20 years.

You'd also like $20,000 upfront to cover some much-needed home repairs and go on a little holiday. You apply for a reverse mortgage that costs $1000 upfront with a 6.5% variable interest rate.

Now the big question: how fast can you expect your equity to run out? The answer depends on three factors:

- The future value of your home.

- How much you borrow and when.

- Interest and fees.

According to the ASIC MoneySmart reverse mortgage calculator, house prices would need to grow by only 1.5% for you to still have more equity in your home in 20 years than you do on day one.

On day one you would have $580,000 in equity ($600,000 less $20,000) and after 20 years, with 1.5% property price growth, you would have equity of $633,243. Clearly, what you could do with $633,243 in 20 years isn't going to be as much but the equity is still there.

Of course, if growth was 0% and interest rates jumped to 10%, the scenario would be a lot different. Your equity would drop right down to $294,000, meaning your initial loan of $20,000 and $200 monthly payments would total over $305,000.

You can play around with the numbers for yourself at moneysmart.gov.au.

Take care and get advice, especially around your options if you believe you may need aged care. Discuss the transaction with Centrelink to ensure you fully understand the impact on any benefits.

While loans entered into from September 2012 contain a protection clause that means you'll never end up owing the lender more than your home is worth, your kids may not get as big a dividend cheque as they were expecting.

Get stories like this in our newsletters.