The top concern facing new homebuyers

By Nicola Field

Eight out of 10 buyers focus on borrowing power, energy warning sparks scramble for solar, and burglar alarms are no match for man's best friend. Here are five things you may have missed this week.

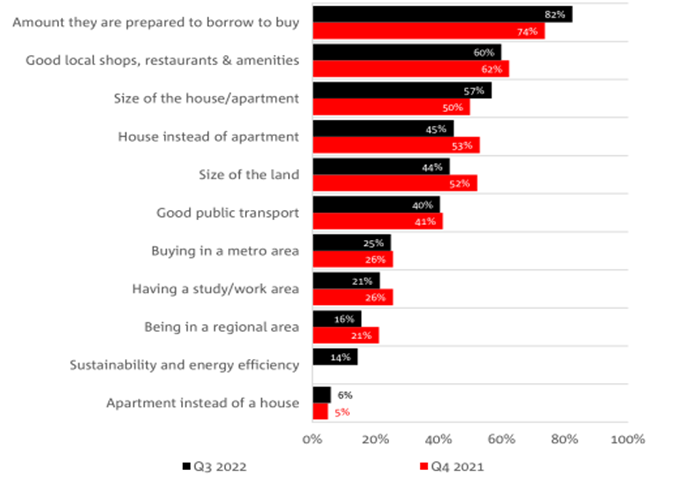

Borrowing power tops homebuyers concerns

NAB's latest property survey shows borrowing power is the biggest factor homebuyers are weighing up in today's market, with 82% concerned about how much they can borrow.

Concerns about borrowing capacity could be well-founded.

A 0.5% rate rise can wipe tens of thousands of dollars from a homebuyer's lending limit - and NAB expects the RBA to lift rates further in coming months, taking the cash rate to 3.1%, up from 2.6% at present.

NAB's executive of home ownership, Andy Kerr says, "In a rising rate environment, where people are uncertain on when the rising rate cycle will end, Australians are more cautious on what they can afford."

Fears of soaring power bills spark interest in solar

When Alinta Energy boss Jeff Dimery warned this week that retail electricity prices could soar 35% next year, it sent a rush of Aussies scrambling to check out solar options.

Solar Quotes reports a spike in consumer interest, saying its web traffic is "off the charts".

Homeowners who install solar panels can benefit from rising wholesale energy prices as it may mean pocketing higher feed-in tariffs. That's the payment homeowners receive for surplus solar energy they feed back into the power grid.

The downside is that solar panels can be expensive.

The Clean Energy Council says it can cost from $2,800 for a 2kW solar system through to over $14,000 for a 10kW system.

Along with feed-in tariffs, home owners may also be eligible for a variety of state and federal government incentives including rebates, low-interest loans and even free smaller systems for low income earners that all make solar make affordable.

According to Energy NSW, solar panels can cut power bills by $600 annually - a saving that could go a lot higher if Dimery's prediction proves correct.

Fido outfoxes burglars

More than half of Australia's homes may be prime targets for burglars.

Compare the Market says the majority (57%) of households don't have any form of home security to deter thieves. Yet, 171,400 homes experienced an attempted break-in between 2020 and 2021.

Compare the Market's general manager of general insurance, Stephen Zeller, says, "With more Australians returning to the office for work or leaving their homes vacant while they take a holiday, it creates a perfect opportunity for brazen thieves."

If you're serious about home security, a family pooch could be your best bet.

A study by the Australian Institute of Criminology found fewer than one in two convicted burglars said an alarm system would prevent them breaking into a property, but 60% would bypass a home with a dog.

A professionally installed and monitored home alarm system can cost up to $4000, often with a monthly monitoring fee of $15 to $60. A homeless pooch on the other hand, can set you back just $480 from a rescue shelter.

It's game on for London

Buckingham Palace has announced the Coronation of King Charles III will take place on May 6, 2023.

If you're thinking of jetting in for the event, it could pay to book flights and accommodation early.

Queen Elizabeth's funeral saw airfares to London double in some cases, and the spike in demand pushed London's average nightly hotel rate up from $A390 to $A613 according to Reuters.

A check of Qantas flights shows return fares from Sydney to London in May 2023 start from around $2120 though only a few seats remain at this price.

Webjet reveals $1555 return flights are available with SWISS, but only if you don't mind the journey taking up to 65 hours.

Or, you could follow the lead of Prime Minister Anthony Albanese, who took a private flight to the UK for the Queen's funeral.

Charter flights from Sydney to London are priced from around $388,000 return (yes, you read that correctly) so it's only an option for the most devoted (and well-heeled) fans of royalty.

Retirement fears on the rise

Three in five Australians are worried they won't have enough to retire, up from two in five in 2020.

That's according to AMP research which shows fears of running out of super prematurely have been heightened by rising living costs. The upside is that more of us are giving thought to retirement plans.

Only 40% of AMP's respondents have not considered retirement planning, down from 60% in 2020.

Ben Hillier, AMP's general manager of retirement solutions, says it's encouraging that more of us are looking ahead to retirement, but adds people's fear of running out of super stems from "a basic lack of understanding - an awareness gap - of their finances and the retirement system".

He adds, "Information and support is readily available and simple steps can help Australians feel more comfortable and confident about retirement."

Your super fund can be a source of free or low-cost advice on how to grow your nest egg.

Get stories like this in our newsletters.