Three ways to invest in AI through ETFs

By Kanish Chugh

Recent breakthroughs in artificial intelligence (AI) have led to a surge in both AI companies and technology companies more broadly.

The biggest beneficiaries have been semi-conductor companies, led by Nvidia, but many other companies could benefit as more organisations turn to AI to speed up operations and boost productivity.

Nvidia is now the fifth largest company in the US, having recently overtaken Berkshire Hathaway and Tesla after surpassing Meta last year.

It is now closing in on Amazon with a market capitalisation of around US$1 trillion after its share price surpassed US$400 in May.

If it overtakes Amazon, that would make Nvidia the fourth-largest company in the US despite it being still relatively unknown outside tech circles. But that is changing.

While AI has existed for years, the launch of ChatGPT has accelerated its move into the mainstream.

We are now seeing the first inklings of impact beyond process automation in the enterprise to true disruption across multiple fields. Big tech names like Microsoft, up around 41% YTD and Nvidia, up around 196% YTD, have been the obvious winners in the AI market so far. Google too is launching its own AI applications and is up around 34% YTD.

However, there is likely to be a wide array of winners from this emerging technology, from the chip makers powering AI, the big tech companies building the software and the long chain of companies benefiting from the implementation of AI.

One thing that's clear is that generative AI has the potential to be a powerful tool for businesses and individuals, and that it will likely play an increasingly important role in a wide range of industries in the future.

With the speed at which the market is accelerating, a core question is arising for investors: are investors overpaying for a technology that could fade away in the months or years to come?

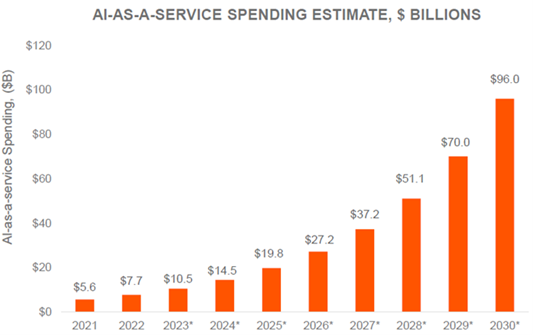

Well, according to estimates, the revenue potential and monetisation of this market hasn't even begun, with expectations of rapidly growing revenue growth, as the chart below shows.

With that mind, we look at which sectors are likely to benefit most from AI, which we have divided into three main groups: semiconductors, big tech, and robotics and automation companies.

Semiconductors

Some of the bigger winners of the AI trade so far have been in hardware, as mentioned with computer chip maker Nvidia, one of the best performing stocks in the S&P 500 this year. Also known as semiconductors, computer chips enable AI applications; Large Language Model's (LLM) rely heavily on computer chips or semiconductors to train AI using large textual datasets.

The growing sophistication of AI and new multitasking capabilities mean that graphics processing units (GPUs) such as those made by Nvidia are becoming increasingly important over Central Processing Units (CPUs) which are common in laptops. The demand for GPUs will likely accelerate as AI applications grow increasingly sophisticated.

Nvidia has been the most visual winner so far of the generative AI trend, but many other companies in the semiconductor supply chain are benefiting too from the increased demand; ASML, which specialises in the development and manufacturing of photolithography machines used to make computer chips, is up 34% YTD.

Chip-maker Broadcom is up 58% YTD while AMD is up 81% and Taiwan Semiconductor Manufacturing Company has rallied 28%. The Global X Semiconductor ETF (SEMI) allows investors to capture the winners of the AI revolution across a diversified portfolio. SEMI has returned 50% YTD.

Big tech

Computer chip aside, companies developing AI apps are being led by mega-caps like Microsoft with its OpenAI collaboration and Google with its internally developed Bard. We are seeing 52-week highs for the big technology stocks such as Apple, Meta, and Google owner Alphabet as the AI theme push them higher.

These FAANG mega-caps are keeping the broader markets like the S&P 500 index, accounting for around 90% of the index's gains this year.

Yet despite the leaps and bounds in AI, revenue from this theme only accounts for a small part of Microsoft and Google's income streams, highlighting potential for revenue from these services to grow to levels seen in spaces such as cloud services.

The revenue will start to show up in areas like search and office packages as these firms integrate AI to further the stickiness of their ecosystems.

Providing exposure to big technology companies, the Global X FANG+ ETF has returned 77% YTD, significantly outperforming the broader Nasdaq 100 and S&P 500 indices.

Robotics and automation

The robotics, automation, and artificial Intelligence (RAAI) industry is another obvious winner of the advancements in AI. There are many secondary beneficiaries in the RAAI space which are using AI to advance existing technologies. Some recent examples of development in the area include ABB Robotics launching its Robotic Item Picker, a new vision-based solution that accurately detects and picks items in warehouses and fulfillment centres.

The private enterprise Boston Dynamics has partnered with AI-software company Levatas to integrate OpenAI's ChatGPT into Boston Dynamics' robo-dog, Spot. With ChatGPT and Google Assistant's voice technology, Spot can understand and converse with humans. Meanwhile, Intuitive Surgical (27% YTD and near 52 weeks highs) are talking to AI and Machine Learning (from their two decades and 10 million procedures) to enhance surgeons' abilities across their key Da Vinci device.

For a low cost, there are several ways investors can play AI themes with ETFs; these ETFs provide diversified exposure to a long-term theme that is likely to keep gaining in importance, pushing up the value of technology companies that are enabling the AI revolution.

Get stories like this in our newsletters.