Is it time to rethink the interest-only loan?

By Maria Bekiaris

Interest-only loans are a popular option for property investors but with rates at historical lows it might be time to rethink this approach.

"With interest rates now around the mid-4% range, and even lower, there's really no need to have an interest-only loan, whether you're an investor or owner-occupier," says Joe Sirianni, executive director at Smartline Personal Mortgage Advisers.

"The significant drop in interest rates in the past couple of years means principal and interest repayments are similar to what interest-only were."

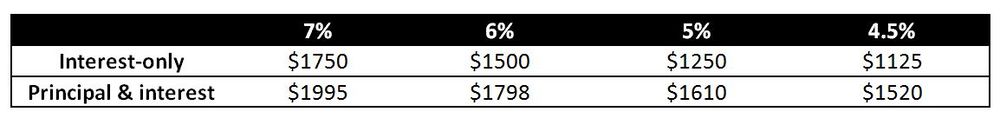

He gives the example of a $300,000 loan for 30 years. As the table below, provided by Smartline, shows, monthly repayments at 7% (interest only) are $1750. At 4.5% P&I they are $1520.

Your P&I repayments might still be a few hundred dollars more than the interest-only payments but the bonus is that you will be paying off some of the principal, which will help you build equity in the property even faster.

And, of course, the repayments are still less than the interest-only repayment of $1750 at 7%.

"If you actually maintained your repayments at $1750, you'd be getting even further ahead," adds Sirianni.

The interest-only loan might soon be a thing of the past anyway, warns Sirianni.

"We are now seeing lenders starting to actively raise the bar in terms of the requirements investors have to meet and the restriction of interest-only loans will probably be one of those moves," he says.

Get stories like this in our newsletters.