Why sooner is better than later when it comes to investing in property

By David Thornton

Young people are less likely to buy a home than they were in the past, new research by the Arc Centre of Excellence in Population Ageing Research (CEPAR) shows.

UNSW Sydney senior research fellow and lead author Rafal Chomik says the findings are in line with key demographic trends - the same way traditional life events are occurring, intentionally or unintentionally, later in life.

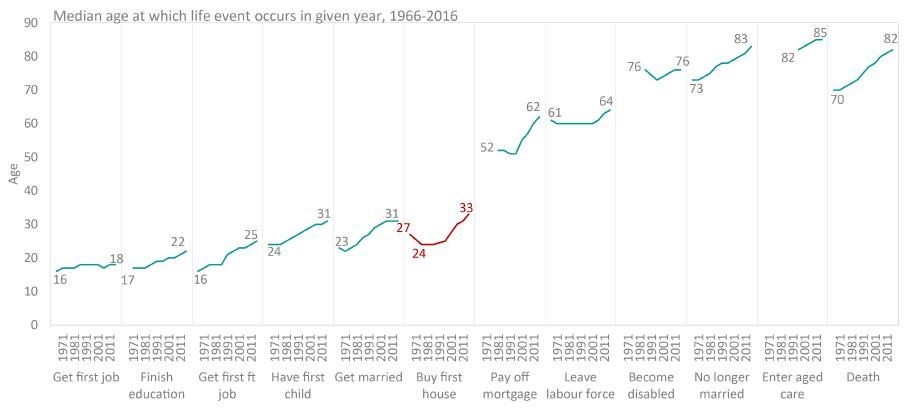

"Over the past 50 years the median age of home purchase has increased by six years, from 27 to 33," says Chomik.

"Over the same period, the median age of getting a first job has increased by two years; finishing education has been delayed by five years; having a child has been delayed by seven years; and getting married is now taking place eight years later."

Older Australian renters are at greatest disadvantage, given the extent to which home ownership bears on financial stability and security. The group exhibits some of the worst relative poverty rates in the OECD.

"Homeownership serves multiple purposes and housing outcomes affect financial and personal health and wellbeing over the lifecycle," says Chomik.

"It acts as home, as well as a store of wealth to guarantee financial security in retirement."

Andrew Crossley, author of Property Investing Made Simple, acknowledges the challenges facing renters.

"Renters end up being worse off in retirement, as they don't have the assets to cash in, providing them capital which they could live off," he says.

"It takes longer to save for a deposit now, but if a person has a choice, there is no logic why they would not invest in a principle place of residence, or if they are going to rent, then at least into an investment property."

However, entering the property market later in life is inherently more risky, and harder to do.

"There comes an age when it is considered more risky to take on debt, this would typically be over 60 years old, certainly 65 years old," says Crossley.

"Additionally, the older someone is, the more difficult it will become in obtaining a loan. Lenders want exit strategies and have to adhere to responsible lending requirements."

By contrast, early property investing means more time for capital appreciation and easier access to mortgage credit.

Crossley's advice for young Australians is "Save for a deposit and get their foot in the door, seek advice, and have a plan."

Get stories like this in our newsletters.