Driver cops $194k speeding fine

By Nicola Field

One in four homes paid for in cash, driver in 50kph zone slapped with $194,000 speeding fine, and which bank copped a $3.55 million fine for spamming? Here are five things you may have missed this week.

One in four homebuyers not fazed by rate hikes

Homeowners grinding their way through 12 interest rate hikes in as many months, may take cold comfort knowing that one group of home buyers isn't at all fazed by higher rates.

Over the last year, an astonishing one in four homes have been paid for with cash.

We're not talking rundown shacks in the middle of nowhere.

A new report from online conveyancing platform PEXA, confirms the median value of cash purchases was $850,000 in NSW, $720,000 in QLD and $595,000 in Victoria.

The ritzy suburbs of Mosman in Sydney, Melbourne's Toorak and Broadbeach on the QLD Gold Coast were among the leading neighbourhoods (by value) for cash purchases.

PEXA says cash buyers tend to be different from the rest of us: they are older and more likely to have an international background. It goes without saying they also have a truckload more cash.

Driver cops $194,000 speeding fine

Next time you're handed a speeding fine, spare a thought for Anders Wiklöf, a driver in Finland, who was slapped with a speeding ticket worth 121,000 euros - about $194,000.

Wiklöf didn't even have his pedal to the metal. He was moving from a 70 kph zone into a 50 kph stretch.

The catch is that in Finland, as in a number of European nations, fines can be based on personal income.

And Wiklöf is no ordinary motorist.

He is the sole owner of Wiklöf Holding, a group of over 20 companies spanning everything from helicopter services to real estate and tourism.

According to the group's website, Wiklöf Holding made a profit of more than 11 million euro in 2020, equivalent to about $17 million, putting Wiklöf in the firing line for a hefty fine.

It's not the biggest speeding fine on record.

That accolade goes to a Swiss driver, who was handed a fine equal to $1.5 million after police clocked his Mercedes hurling along at 290 kph.

According to Swiss media, the driver claimed his speedometer was on the blink, but the local constabulary didn't buy it.

Commonwealth Bank fined $3.55 million for spam breaches

CommBank has paid a record $3.55 million penalty after it sent more than 65 million emails that did not comply with Australia's spam laws.

An Australian Communications and Media Authority (ACMA) investigation found the bank sent more than 61 million marketing emails to customers that unlawfully required them to log-in to unsubscribe.

CommBank sent a further 4 million marketing emails that did not have a functioning unsubscribe facility.

CommBank was also found to have sent more than 5,000 marketing emails to customers who had asked to unsubscribe from these messages.

ACMA Chair Nerida O'Loughlin says companies must give people the option to unsubscribe from marketing messages - and make it easy to do so.

"The scale and duration of the breaches by the Commonwealth Bank is alarming, especially when the ACMA gave it early warnings it might have some issues and the steps it took were ineffective.

The failure to fix the issues shows a complete disregard for the spam rules and the rights of its customers," says O'Loughlin.

This is the largest penalty imposed by the ACMA for breaches of spam laws, which require marketing messages to contain working unsubscribe facilities.

Making consumers log-in or provide personal details to unsubscribe is generally prohibited.

Once a message recipient has unsubscribed, sending further marketing messages is also against the law.

If you're having issues with spam, jump onto the ACMA website or call them on 1300 850 115.

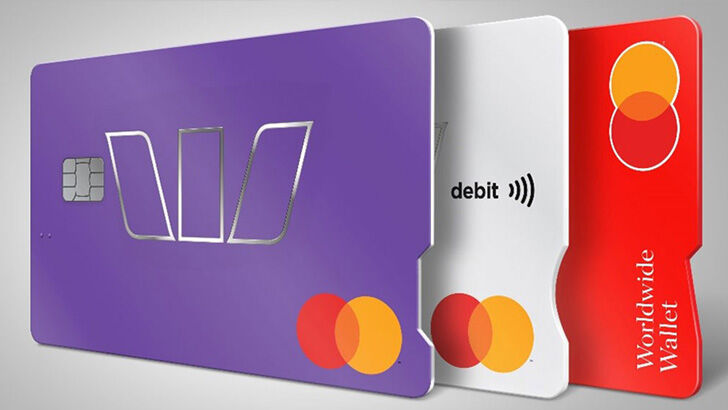

Westpac launches cards for low vision Aussies

Westpac is rolling out a suite of new card designs to help make payments more accessible for blind or low vision customers.

The credit, debit and pre-paid cards will incorporate new accessibility elements, including different notches along the short edge to enable customers to distinguish their payment cards from one another using touch alone.

Using Mastercard's Touch Card feature, the notches - square for credit card, round for debit card and triangular for pre-paid card - help customers identify the card and orient the card correctly when making payments or using an ATM.

The cards will also include a braille marker, providing another tactile feature to help blind or low vision customers distinguish between credit, debit and prepaid cards.

Westpac chief brand and marketing officer, Annabel Fribence, says, "The features of the new cards are a simple but innovative step forward that will make a big difference in the day-to-day lives of many blind or low vision Australians."

Sally Aurisch, CEO of Blind Citizens Australia, says, "Measures like this can go a long way to giving customers who are blind or vision impaired that extra bit of confidence and independence when stepping up to the payment counter."

Cheques to be phased out by 2030

Australia's payment system is about to be overhauled, and the humble cheque is being consigned to the history books.

Federal Treasurer Jim Chalmers announced several initiatives including the phasing out of cheques by 2030.

The use of cheques has plunged 90% over the past decade, now accounting for just 0.2% of all payments.

Many banks have stopped issuing new chequebooks altogether.

On the flipside, the value of mobile wallet transactions have skyrocketed to $93 billion, as 98.9% of bank interactions take place digitally via apps or online.

Cash is used for just 13% of payments, down from 70% in 2007.

Get stories like this in our newsletters.