Bank of Mum and Dad buyers most at risk

By Nicola Field

Aussies pocket $10 billion profit in ETFs, Bank of Mum and Dad buyers most at risk, and property market reaches new record. Here are five things you may have missed this week.

Australians made nearly $10 billion profit in ETFs over the past year

The Australian market for exchange traded funds (ETFs) grew 32% over the last 12 months - and has quintupled in size over the past five years, growing at a rate of 38% annually.

That's according to the 2022 Stockspot ETF report, which claims Australians made nearly $10 billion profit in ETFs over the past year.

With results like that it's no surprise that ETFs are not just being used by grown-ups.

The report shows Stockspot Kids' accounts have grown by 45% as parents and grandparents are increasingly looking for ways to invest for their children and grandchildren rather than keeping money in a low interest savings account.

The cost of kindness: Bank of Mum and Dad may cause mortgage heartache

First home buyers in five local government areas (LGAs) of NSW are at higher risk of losing the roofs over their heads following recent interest rate rises, according to property data provider, National Property Group.

The probable culprit? Well-meaning parents.

Fuelled by a mortgage lending spree, 2021 was a record year for Australia's ninth biggest lender, the Bank of Mum and Dad.

A whopping 60% of first home buyers turned to their parents for financial assistance to make their property dreams a reality, with Bank of Mum and Dad loans totalling a staggering $34 billion.

But experts warn that those who borrow money from their parents to fund a property are twice as likely to default on their mortgage within five years.

"Our data identifies key markets across metro and regional NSW where home values are starting to fall, which increases the risk of negative equity for some previous purchasers," says Don Harb, chief operating officer of National Property Group.

He cautions, "The local government area of Ryde has seen a 16.8% fall in property values. We're also seeing slight dips in home prices in regional LGAs such as Queanbeyan. For Bank of Mum and Dad buyers and lenders, these trends could signal that it's time to assess their financial future."

Property market tops $10 trillion mark

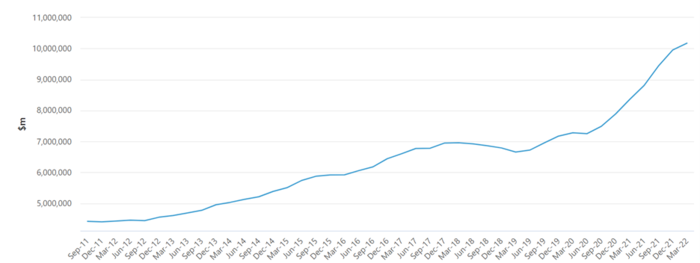

The total value of Australia's residential property market rose by $221.2 billion in the March quarter 2022, according to the Australian Bureau of Statistics (ABS).

It brings the total value of Australia's 10.8 million dwellings to $10.2 trillion for the first time.

Michelle Marquardt, head of Prices Statistics at the ABS, says, "The total value of residential dwellings rose $1.8 trillion in the 12 months to the March quarter 2022 from $8.4 trillion in the March quarter 2021."

The market trend shown in the ABS graph below highlights that while residential property may have its share of ups and downs, the long term trajectory is upwards. Good news for those concerned about the current cooling of the market.

New agribusiness index launched

The combination of supply chain issues, conflict in Ukraine and flooding on Australia's east coast has seen rising food costs make headlines. But as food shortages become a global concern, investors are turning their attention to the agribusiness sector.

This has driven the launch of a new Aussie sharemarket index - the S&P/ASX Agribusiness Index.

The new broad-based index includes companies that produce agricultural products as well as those that make inputs used in agricultural products.

Ken Chapman, Head of Strategic Delivery, Capital Markets at ASX, says, "By raising the profile of the sector, the AgBiz Index will increase investor understanding and interest, and be a critical ingredient in priming the market for the next phase of agricultural innovation."

Despite its infancy, the new AgBiz Index fell 8% in June.

Younger generation leading SMSF spike

The Vanguard/Investment Trends 2022 SMSF Report says Self-Managed Super Funds (SMSF) are enjoying a resurgence, driven by a new breed of younger trustees who are more confident and more engaged with their super.

According to the report, the desire for more control over investments remains a key driver for using a SMSF. However, younger SMSF trustees are also aiming to achieve better returns than APRA regulated funds.

Balaji Gopal, Head of Personal Investor, Vanguard Australia, says, "Research tells us that a record number of new investors made their first trade during the pandemic and a large proportion of these new investors were Millennial and Gen Zs.

"Unsurprisingly, many of them want full control of their retirement, and superannuation is a vital component of that journey."

Consistent with previous years, the report shows SMSFs continue to allocate more than half their portfolio to direct shares and cash.

The 13% drop in Aussie shares over the last quarter could mean recently established SMSFs are facing a bumpy ride.

However, Gopal advises, "History has shown that disciplined investors who stay the course and ignore the short-term noise from financial markets are rewarded when indices eventually rise."

Get stories like this in our newsletters.