Should you buy, hold or sell shares in Sims Limited?

For those investors looking to gain more exposure to the thematic of sustainability, companies that participate in the circular economy, and the idea that materials and products can be reused, shared and recycled for the benefit of society, then Sims should be top of the list.

Sims Limited (Sims) is one of the world's leading publicly traded metal and electronics recyclers and is leading the way to a more sustainable future.

Founded in Australia in 1917 and listed on the ASX since 1948, Sims comprises several divisions with a clear focus on profiting from the buying, processing and selling of ferrous metals (iron and steel) and non-ferrous metals, principally copper, aluminium, lead, zinc and nickel.

Sims also has several other sustainably focused businesses that allow it to leverage synergies from its core metals trading business.

For example, the Lifecycle Services business provides decommissioning, disposal and data destruction services as well as electronics recycling to enterprises and data centres globally.

Its Municipal Recycling division develops recycling solutions for major cities, processing curbside recyclables (bottle, cans, plastics and papers) from five facilities in New York and the northeast United States.

The Resource Renewal division aims to reuse the waste from metal recycling processes to produce new products such as aggregates for construction and hydrogen for industrial use and thus ensuring that this waste does not end up as landfill. And finally, through its joint venture LMS Energy, Sims is also engaged in energy production via several landfill biogas to renewable energy projects in Australia.

Sims enjoys a market-leading position in its chosen markets of the United States (#1), UK (#2), Australia (#1) and New Zealand (#1) and employs more than 3880 employees across more than 260 facilities in 15 countries.

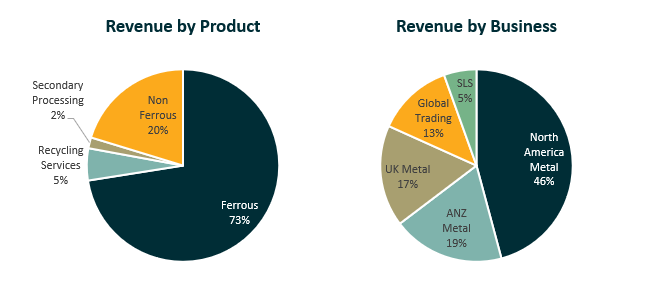

In financial year 2021, Sims generated just under $6 billion in revenue. The graphs below show how this revenue is split by product and business.

Strategy

Sims is exposed to several structural tailwinds based around the increasing awareness for society to embrace sustainable practices. Sims has built its strategy to take advantage of these whilst targeting a minimum 15% return for growth projects. These structural tailwinds fall into three categories.

Overall demand for ferrous metals is expected to increase. The International Energy Agency's (IEA) Iron Ore and Steel Technology Roadmap for the industry forecasts a 40% increase in global steel production by 2050, driven by an increase in infrastructure, buildings and machinery and green energy projects.

One of the key advantages that Sims has is the global uptake of electric arc furnaces (EAF) to produce steel favoured for its lower energy needs and therefore cleaner carbon footprint. EAFs use scrap metal as a feedstock as a substitute for iron ore used in traditional steelmaking.

In addition to the increasing ferrous metals demand, copper, aluminium and nickel are key inputs into clean energy production, transmission and storage.

The demand for these metals is expected to increase dramatically as the energy transition gathers pace. Indeed, Sims' renewable energy projects, resource renewal developments and municipal recycling infrastructure are all key growth areas as Sims takes advantage of environmental concerns, especially around finding pathways to mitigate and slow global warming.

As technology and data use grow exponentially, the need for infrastructure also grows. A sustainable approach using repurposed equipment will be a major demand driver for the Lifecycle division as technology companies commit to carbon reduction, waste reduction and other ESG goals.

Returns

Over the past 10 years, an investment in Sims would have returned 7% a year including the reinvestment of dividends. This compares with an annualised return for the S&P/ASX 200 Index of 9.2%.

Sims currently pay 37% of its profits out to shareholders as dividends, which results in a current cash dividend yield of 5.1%. The dividends are not franked given the global nature of Sims earnings. Considering the lack of franking credits available Sims commenced a share repurchase program in September 2021.

ESG considerations

The underlying Sims business contributes to a more sustainable society with the enablement of the circular economy and business objectives that target better use of materials and a reduction in waste. But how does this stack up in practice?

Our assessment of the environmental, social and governance (ESG) metrics of Sims place the company in the top half of peers. The company has set several clear and trackable targets for 2025 and beyond.

Furthermore, these are aligned with three of UNs Sustainable Development Goals of decent work and economic growth, climate action and responsible consumption and production. Sims scores well on workplace safety, gender diversity and pay gap metrics. In terms of emissions Sims has committed to become carbon neutral by 2030 and achieve net zero by 2050.

Recommendation

- BUY

We currently rate Sims as a Buy. The company scores well on fundamental metrics with a sound balance sheet and low debt, attractive returns on capital and a valuation that is undemanding compared to international peers.

Key risks to the business centre around the outlook for the global economy which has deteriorated somewhat over the last few months. Cost inflation is another potential issue given the situation with escalating freight and labour rates that have been experienced recently.

However, over a longer term, Sims leading market position and geographically diverse customer base gives it a stable platform to take advantage of some strong supportive trends in the year to come.

Get stories like this in our newsletters.