Being conservative could cost you your retirement

By Vita Palestrant

As a super fund member, you typically spend your working life drip-feeding monthly contributions into your account without thinking about it too much. But thanks to your time in the market, dollar cost averaging and the power of compounding, those savings could land up being your biggest asset outside the family home.

Default super funds - where most members' money is invested - have performed extraordinarily well, earning Australia an enviable reputation around the world.

But what happens when the drip-feeding stops and retirement starts?

There is no shortage of research that shows many retirees face retirement with trepidation.

Members could turn to their fund and get free intra-fund advice, but it won't take their partner's super or other assets into account.

Funds have largely focused on accumulators rather than retirees. But, unlike the accumulation phase of super, there is no regulated default retirement product.

Yet the bulk of super assets sits in the hands of members aged over 50, prompting calls from the federal government for the industry to come up with strategies and investments that are specifically designed for the pension phase.

Lasting the distance

"While the positive impacts of compounding and dollar cost averaging are well understood when it comes to saving, many people are not aware that the opposite is true during decumulation," says Richard Dinham, head of client solutions and retirement at Fidelity International.

"In fact, limiting losses in retirement has a more powerful effect on long-term growth than capturing the full upside of market gains.

"When you are working, you have an income that is generally dependable, but when you finish working and move into retirement, you've got your super and whatever else you might have accumulated, and your attitude to risk changes.

"I'd say 90% of people will be a lot more cautious because they have this pool of money that needs to sustain them for the rest of their lives," he says.

Dinham says retirees' reduced risk capacity makes them more sensitive to falling markets. "Retirees who withdrew from investment markets during the GFC and switched to cash may never have recouped their capital losses."

When COVID hit last year, the falls were a lot shorter and sharper. "There were nervous investors who switched. But again, you have to stay the course, stay invested and, sure enough, markets will go to above where they were before," he says.

"If retirees take very little risk, if they go into a very conservative portfolio, they should expect

a poor outcome. They will run out of money a lot quicker."

Limit the downside

Fidelity's research paper, Building Better Retirement Futures, written in conjunction with the Financial Planning Association of Australia and CoreData, says retirees need to take appropriate investment risk to address inflation and longevity risk while also limiting the impact of market volatility.

That generally means holding a moderate growth portfolio with about 40% growth assets and 60% defensive assets. Over an extended period it is likely to produce good results.

"Retirees need to recognise they still need to take some investment risk in their portfolio. It's about taking the right kind of risk," says Dinham.

However, when people switch to pension mode, they may be left in the same investment option they were in, which for most members is the default (balanced) option, which typically has a high exposure to growth of up to 80%.

"More funds have started to default members into more conservative investment options if they don't make an investment choice," says Dinham. But as far as he is concerned, this doesn't go far enough.

"They are still invested in the same kind of equities, when the portfolio should hold more defensive equities. Think about those equities that tend to be more robust in volatile markets, like utility companies and consumer staples like Woolies and Coles.

"They are not very exciting - they're not like Apple or Google or all the rest of them - but they do well when markets are difficult. They still give you the exposure you need to equities."

"The issue is that a lot of funds don't separate their pension assets for retirees from those of accumulators. They're all in one co-mingled pool of assets. They are managed in the same way.

That means retirees have not been front of mind when they've been putting their structures together.

Almost none are doing that at this point in time because they're investing for accumulators."

Dinham says some funds are working on what's called a glide path.

"Allocation changes through time, as people age. That's an innovation that is coming through."

Take the bucket approach

The advantage of having a separate cash "bucket" is to serve as a buffer against failing markets and not having to draw down on assets in a falling market.

"You're not having to draw down on that riskier pool of assets if markets are depressed. It helps with managing that risk," says Dinham. "I'm a strong advocate of the approach. It makes a lot of sense in terms of managing unexpected market events. We don't know when the next GFC or crisis might be.

"If you have that cash bucket there, it could have three years of income as a minimum, and it will keep you going for all your needs during that period."

Then, as your portfolio recovers and increases in value over time, you can top up your cash bucket. It's a simple but effective strategy that some funds embrace.

"It's one piece of the puzzle and the other piece of the puzzle, in my view, is that you need to manage the amount of risk in your riskier assets. You need to take some risk but minimise it if you can. Keep it to a manageable minimum, then you still get the growth for retirement you need; you just reduce the effect of that down market.

"So, it's a combination of the cash bucket, or some other kind of bucketing arrangement, and a more defensive equity allocation with more defensive growth assets. A combination of those two things makes a lot of sense."

As far as the super funds go, Dinham says the focus should be on better outcomes for retirees who don't want to take on so much risk.

"They want steadier performance through time and want to be able to sleep at night knowing there's not too much risk on the table. There needs to be a change in focus towards outcomes and less on performance."

Seek financial advice

No single investment strategy is likely to suit all retirees. For some people, the age pension will be a significant component of the income they receive in retirement. For those with significant super balances and assets outside super, a more tailored, professional approach may be called for.

A do-it-yourself approach means you risk getting things badly wrong and not maximising your wealth. Everyone knows how mind-numbingly complex the environment is.

"Governments are always looking to change social security or super rules or tax and that can have a dramatic and detrimental effect on your retirement affordability," says Ben Marshan, head of policy, strategy and innovation at the Financial Planning Association.

"Having someone there who knows you and what you are trying to achieve means they can quickly and easily deal with that situation because that's what they do on a day-to-day basis. Otherwise you have to sit there and navigate it yourself.

"You've got to actively manage your money in retirement more so than you do in accumulation. You have to educate yourself and understand the different risks and different needs, and manage it yourself or outsource that to a professional."

Marshan says a lot of Australians like to work with a professional who understands them and who they can trust; someone who can put them in a good financial position and take the complexity and uncertainty out of the process.

"All the assets you have are basically it. You have to manage them to pay your income, and for it to last a lifetime and, ideally, grow. What you want to be thinking about is how you manage your investment risk so you have money available when you need it but money growing for the long term."

"There are a lot of different fee models these days. You can always find one that suits you, that works for you." Your super fund may also have in-house planners."

Marshan says you can have an ongoing relationship with your adviser or see them when and if you need to on a case-by-case basis. You might only need to see a planner every few years, or you might want to review on a year-by-year basis.

Once you choose an adviser you will have an initial meeting that is free so that they can understand your financial position, what your goals are and what you need, he says. "The financial planner will never ask you to pay upfront. They will follow up the meeting with a service agreement with an estimate of the costs."

Marshan says there is a considerable amount of consumer protection around financial advice.

"There are very strict rules and principles planners need to comply with and they are obliged to work in your best interests."

When losses are locked in

"When you are investing for your retirement, working and making contributions over a very long time into the future, some of those investments are made when markets crash," says Fidelity's Richard Dinham.

"So that concept of investing through a long period of time is beneficial. Some of those contributions you make perform very well because they've been made at times when markets have been depressed."

For instance, if you were investing $100 a month, and continued to do so through the GFC, when markets fell by 50%, that $100 you made at the bottom of the market would have doubled in value in a year.

"Volatility in markets is beneficial when you are saving. If you are disciplined and keep on investing throughout your savings period, sometimes the contributions you make really pay off in the long term.

"But the opposite happens in decumulation. Imagine you are drawing down your monthly income at a time when markets have fallen. Then markets subsequently recover but you've taken that money out. It's not going to get that benefit of the recovery. You've locked in a lot of permanent loss that will never be recovered.

"That's the concept of dollar cost averaging working against you in the situation where you are a retiree taking an income. So, it's harder for retirees. They have a shorter time horizon, and they are having to draw capital from their savings every year and sometimes it will be

at a bad time."

So, what works in accumulation isn't necessarily the right approach for retirement.

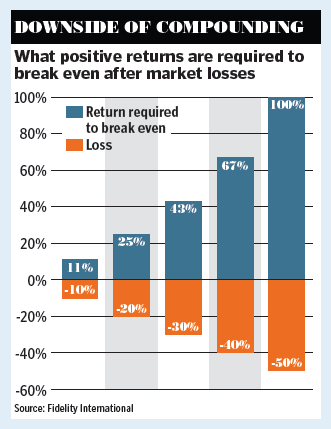

The chart shows what positive returns are needed to break even after a market loss. A 50% loss needs a 100% gain simply to return to the original balance.

Get stories like this in our newsletters.