Five ETFs to help inflation-proof your portfolio

2022 has so far been fairly jarring for investors - with returns from both bonds and equities under pressure due to a rise in global inflation and interest rates.

Indeed, it's hard to believe after years of worrying about deflation, but headline consumer price inflation in the United States is over 8% - the highest in 40 years.

Even in Australia, headline inflation is just over 5%, the highest since the early 1990s.

What's to account for the rise in inflation?

For starters, global demand has recovered strongly over the past year, as consumers emerge from COVID lockdowns cashed up and ready to spend. In turn, strong demand has aggravated lingering supply-chain disruptions, creating product shortages and higher prices. Add to the mix Russia's invasion of Ukraine - which has disrupted the global supply of food and energy and contributed to the upward pressure on prices.

To contain the upsurge in inflation- and prevent the development of a potential wage-price spiral due to tight labour markets - central banks are starting to hike interest rates. Rising interest rates in turn have placed downward pressure on equity valuations and given rise to concerns of a global growth slowdown.

All this begs the question: how can investors protect themselves if the lift in inflation proves to be persistent?

One area of potential interest in this heightened inflationary period is commodities.

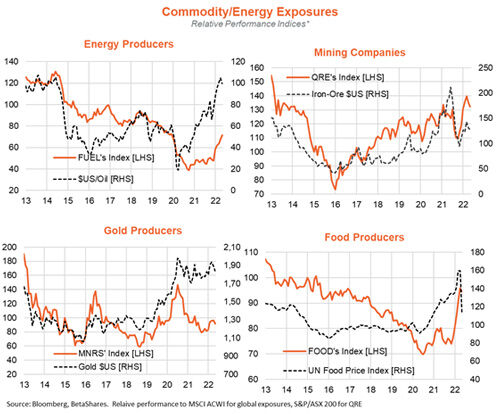

The chart, for example, below depicts the relative performance of various commodity-related ETF exposures:

Source: Bloomberg, BetaShares. Relative performance to MSCI ACWI for global exposures, S&P/ASX 200 for QRE. Past performance is not indicative of future performance.

As evident, all have enjoyed solid performance versus global equities over recent months, in line with the strength in oil, gold, food and iron ore prices. As is also apparent, commodity exposures, in general, have been outperforming since late last year - before Russia's assault on Ukraine - in line with the solid post-COVID recovery in global economic growth.

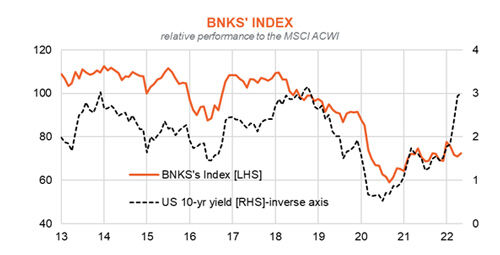

The fifth exposure which has tended to do relatively well in an environment of rising interest rates is global banks (ASX: BNKS). This is because rising rates tend to be associated with stronger profits margins as medium-term bank lending rates tend to widen by more than the cost of short-term funding costs. Rising credit demand due to strong economic growth also tends to be supportive of global banks.

As seen in the chart below, global banks have tended to outperform since late 2020 - in line with the trend higher in bond yields. They suffered a modest relative performance setback more recently despite the further surge higher in bond yields.

This appears to reflect concerns over the possible financial market impact of global sanctions on Russia, such as the write-down of certain Russian financial assets and even a potential sovereign debt default.

That said, given the substantial lift in global interest rates - and the likelihood they may well rise higher or at least hold around current levels - there appears to be scope for further potential "catch-up" relative performance by global banks in the coming months.

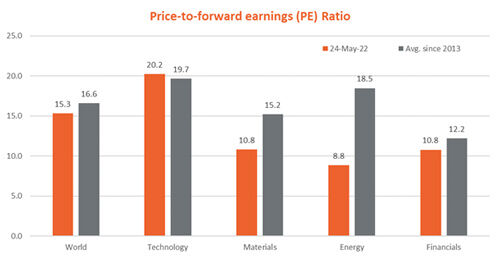

Last but not least, it's also worth noting that energy, materials and financial stocks are still trading at reasonable price-to-earnings discounts from their long-run averages.

The global MSCI materials sector is trading at a price-to-forward earnings ratio of 10.8 compared with an average since 2013 of 15.2*. The same attractive valuation argument also broadly holds true for the energy and financial sectors.

By contrast, even with the sharp decline in the global technology sector in recent months, current PE valuations are now only back in line with their long-run average.

*Averages since 2013 are used as a reasonable valuation metric as global bond yields broadly began to flatten out from this period after having trended downward for several decades previously.

Get stories like this in our newsletters.