Why it's time to hold your Wesfarmers shares

Some readers may not know too much about Wesfarmers (ASX: WES) or have ever heard of the company, but almost all of us will have interacted with the businesses that underly Australia's largest conglomerate.

Wesfarmers is one of Australia most diverse companies owning several well-known retailers such as Bunnings, Officeworks, Kmart, Target and Catch.

In addition, Wesfarmers also owns chemicals, energy, fertilisers and lithium businesses as well as industrial and safety businesses which all operate under a range of brand names.

The result is a company that is currently worth more than $50 billion, with more than 1000 locations across Australia and New Zealand and employing over 114,000 people.

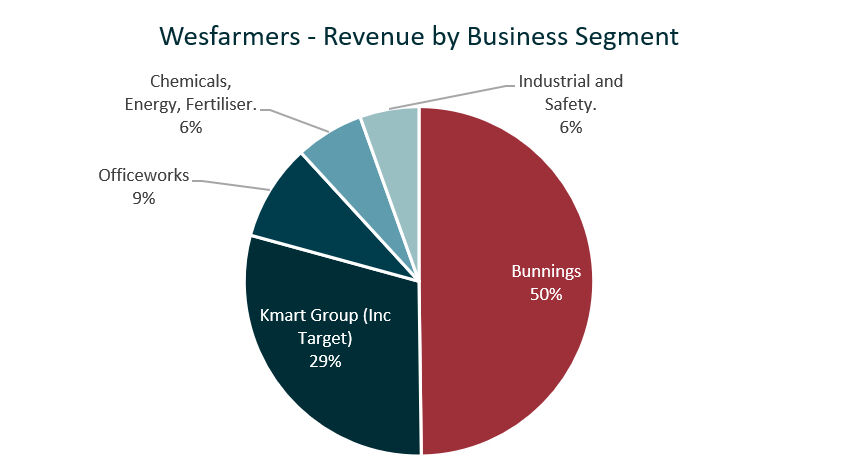

Wesfarmers is divided into five business segments. The below graphic shows the distribution of revenue by business segment. Bunnings now contributes to 50% of revenue and over 60% to earnings before interest and taxes (EBIT). It is clearly the standout business in the portfolio, and it saw off a major competitive threat after the closure of the Woolworths-backed Masters Home Improvement business in 2016.

Bunnings has been described by some market commentators as the best business in Australia. Indeed, its brand loyalty and strong competitive position are evidenced in the high EBIT margins it produces.

Most recently, Wesfarmers completed the acquisition of Australian Pharmaceutical Industries (API) which will see it develop a new division focused on health.

API is a wholesale distributor of pharmaceuticals, best known through its pharmacy chains, Priceline, Pharmacist advice and Soul Pattinson.

In recent years Wesfarmers has also divested businesses. The company has exited its coal mining assets, Kmart Tyre and Auto, and sold its remaining stake in supermarket chain Coles after having demerged the entity to shareholders in 2018.

Returns

In the last 10 years Wesfarmers has achieved a 17% annual return, when reinvesting the dividends, compared to the consumer discretionary sector which has returned 14.4% and the broader S&P/ASX200 index which returned 11.8%.

Wesfarmers returns are made up of share price appreciation, approximately 33%, with the remainder of the returns coming from dividends which are fully franked. Wesfarmers current dividend yield is an attractive 7.4%. Retirees and non-tax paying investors receive further value from the imputation credits that are attached to the dividend payments.

Wesfarmers currently pays out approximately 85% of its profits back to shareholders as dividends.

Wesfarmers underlying businesses in the retail sector have been major beneficiaries of the COVID-19 pandemic as customers spent additional time at home during lockdowns and centred their attentions on increasing house prices and home improvements. The work from home movement has been especially beneficial for Officeworks as people upgrade their home offices.

As COVID-19 issues have subsided, Wesfarmers' earnings have normalised somewhat, helping to explain the 15% share price loss in the first quarter of 2022.

Outlook

Opportunities exist for Wesfarmers to increase margins through a development of its digital offering, taking advantage of the benefits of scale that can be achieved by integrating systems across each of its retail businesses. Improvements in these areas would provide a welcome increase in profit margins.

API adds an additional revenue stream that is somewhat diversified and less discretionary than its other retail businesses. This has the potential to diversify revenue while also providing a new avenue for future growth.

The key risk for Wesfarmers is any downturn in discretionary spending. This risk appears a real possibility as higher interest rates in 2022/23 flow through to increased mortgage costs and inflation results in higher priced everyday essentials such as petrol, energy, and food. This in turn reduces the money households can spend on discretionary items.

ESG Considerations

Wesfarmers scores above average on environmental, social and governance (ESG) metrics, particularly on social issues such as, health and safety, training and development, and diversity, which are particularly important metrics given its large workforce.

On environmental issues, Wesfarmers, has recently reduced its Scope 1 and 2 emissions working towards a committed to target of net zero Scope 1 and 2 emissions for its retailers by 2030 and the rest of the business by 2050.

Recommendation - HOLD

We rate Wesfarmers a Hold on current investment criteria. Our financial statements analysis metrics are neutral. Wesfarmers clearly has some better-quality businesses in Bunnings and Officeworks. Unfortunately, these are offset by issues in Kmart and Target as evidenced by the recent restructure of the target network.

The fertiliser business should see some benefits from the recent boom in prices due to Russian fertiliser supply now constrained by their own actions in Ukraine. From a valuation perspective, the company is trading on a price-to-earnings (PE) ratio of 25x.

This is above its long-term average of 19x and seems expensive given the potential headwinds from a possible decrease in consumer discretionary spending and a lack of growth drivers after their recent COVID-19 related boost.

For those that hold Wesfarmers, the company offers a diversified exposure to the Australian consumer with the bonus of a healthy dividend yield.

Get stories like this in our newsletters.