Bonds for beginners: how they work and how to buy them

By David Thornton

High-quality bonds are arguably the leading defensive asset for retail investors, lauded for their capital preservation qualities. But what exactly are they and how do you buy them?

Bonds are essentially loan contracts issued by either governments or companies. You loan them the money and, in exchange, you'll receive coupon payments (yield) and, at the end of the agreed term, the initial loan amount (face value) of the bond.

Because they're issued by governments or large companies, they're considered a safe asset, second only to cash. Australian government bonds are AAA rated, the top credit rating, so creditors - in this case, you - will almost certainly be paid.

For this reason, bonds have fixed-income stalwarts.

How they work

Investors can hold bonds until they mature or sell them before this point on the secondary market.

Their price on the secondary market is a combination of the bond's face (par) value and the demand for it in the secondary market, which will add a premium or discount.

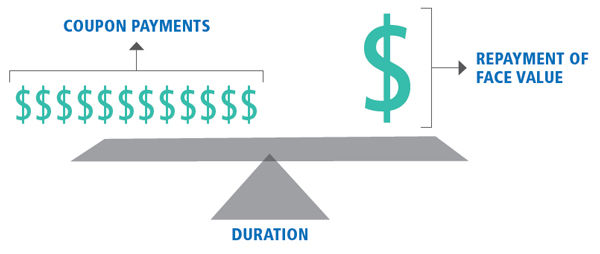

The demand for a bond on the secondary market is influenced by its duration, which is a measure of a bond's interest rate risk. The duration measurement takes into account the bond's maturity, yield, and the coupon payments left to be paid out.

Bonds are therefore more or less affected by the interest rate environment depending on their duration.

If interest rates go up, the bond will trade at a discount because newly issued bonds will pay investors higher coupon rates than old ones, and vice versa. The higher the duration, the more sensitive the bond will be to changes in interest rates.

How to buy

Government bonds can be bought and sold on the ASX as exchange-traded treasury bonds (eTBs), and they are traded in the same way as regular stocks.

Corporate bonds can be purchased directly from the issuer through a public offer at face value. You can also trade them on the secondary market via the ASX, where they're called XTBs.

Another option is to invest in a professionally managed bond fund, which pools investors' money in order to purchase a collection of bonds. It's important to remember that managed funds typically have management and sometimes performance fees.

Bond ETFs, which passively track bond indices, are a cheaper way to gain diversified exposure to the bond market. Betashares, ETF Securities, iShares, Vanguard and State Street all offer bond ETFs.

Get stories like this in our newsletters.