The company charging ahead to become Europe's largest EV battery recycler

By Carl Capolingua

Neometals (NMT) is an exciting technology company that aims to become a major player in the rapidly growing electric vehicle (EV) battery industry. Within two years, the company intends to be Europe's largest battery recycler, while also becoming one of the world's lowest-cost producers of key battery materials.

Neometals is tackling the world's transition to electric vehicles in a very different way from the high-flying mining companies that produce EV battery component minerals.

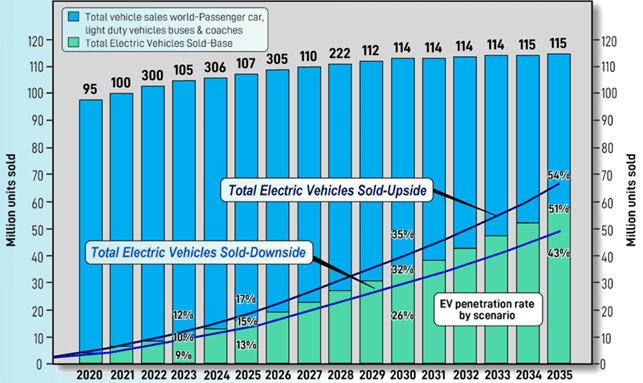

It is expected that EVs will make up roughly half of all passenger and light-duty vehicles, busses and coaches sold by 2035.

The demand for battery component minerals is expected to increase significantly as a result. Whilst many ASX companies aim to capitalise on the impending boom by supplying inputs to the battery making process, Neometals is also targeting the opposite end of a battery's life cycle, that is, how to dispose of batteries once they are spent.

The beauty in Neometals' approach compared with a lithium miner is that it solves two EV battery problems. Firstly, what to do with the batteries at the end of their life cycle.

EV batteries have a finite life, and they also contain a number of very nasty materials that could pose a threat to the environment. The batteries, which can weigh in excess of 300kg, are generally considered to be hazardous waste, and therefore stockpiling and landfilling are not options.

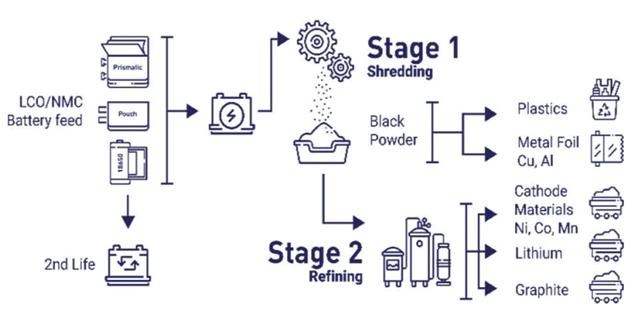

This is where Neometals steps in. It has developed a proprietary, sustainable process for recovering many of the valuable constituents from scrapped lithium-ion and nickel-manganese-cadmium batteries.

Its recycling process recovers over 90% of the useful materials in spent batteries. These recovered materials can then be sold to battery manufacturers to make the next generation of batteries. So, Neometals stands to benefit from demand at both ends of the battery life-cycle spectrum.

Neometals' core project is its Primobius joint venture, in which it has an equal share with Germany's SMS Group, a leading metallurgical plant specialist. The venture is currently at demonstration plant phase.

The demonstration plant has the ability to process 1 tonne per day (tpd) of battery materials, with the aim of successfully processing 10 tonnes of battery materials in total during this phase. Based upon satisfactory performance of the demonstration plant, and assuming a final investment decision is taken, the plan is to construct a plant capable of processing up to 50tpd, for annual processing of 18,250 tonne per annum.

This would make Primobius Europe's largest battery recycling plant by feed capacity. A decision is due around March 2022, and would likely provide a major catalyst for Neometals' share price.

In addition to providing an environmentally sound solution to the battery recycling problem, Neometals stands to become a substantial producer of key battery materials such as nickel sulphate, lithium, and cobalt sulphate in its own right.

Also, because its process is so much cheaper and cleaner than hard-rock mining, it is likely to be one of the world's most environmentally friendly and lowest cost producers of these materials. Neometals has also commenced similar joint ventures in Japan and Canada with a view to servicing the Asian and North American EV markets respectively.

Neometals is also advancing two vanadium projects, one focused on recovering high-purity vanadium pentoxide (V2O5) from high-grade vanadium-bearing steel by-products in Scandinavia, and the Barrambie Vanadium and Titanium Project in Western Australia.

Vanadium is a key component in the production of hardened steel and in the manufacture of super conducting magnets, both of which are also important EV components.

While each Vanadium project is at a relatively early stage of development compared to Primobius, each is high-grade, low cost in nature, and each may add substantial value to Neometals' share price in the medium-term.

Neometals' balance sheet is strong with $98 million in cash and no debt. It will need a significant portion of that cash, and likely the addition of some debt (we estimate approximately $40-$50 million) to fund its share of the capital required to see Primobius through to full production. Cashflows are unlikely until at least the second half of 2023 when Primobius is expected to become fully operational.

For this reason, there are elevated risks in terms of execution, and with respect to forecasting future cash flows to calculate a fair value for Neometals' shares. So, Neometals' blue sky potential also comes with elevated risks, and investors should consider this before making an investment.

We note that similar assets have sold for more than double Neometals' current valuation in the recent past, and this should provide support for the current market capitalisation of around $475 million. After fully considering the risks and potential rewards, we believe that Neometals is an exciting ground level opportunity, with an early mover advantage in the battery recycling space.

Get stories like this in our newsletters.