Should young Aussies pay off HECS debt or invest?

Young people earning money above and beyond their living expenses face a choice: pay down their tertiary education debt or invest?

While everybody has their own unique circumstances, there are a few key things to keep in mind.

If you undertook your tertiary education on a Commonwealth-supported place (CSP), you'll likely have received a helping hand from the government in the form of a HELP loan. Your HELP debt is the money borrowed from the government to undertake tertiary education. That covers loans labelled as HECS-HELP, FEE-HELP, VET FEE-HELP, OS-HELP, SA-HELP and VET student loans.

This money is paid back depending on your level of taxable income. If you earn less than $47,014, you don't pay anything. Between $47,014 and $54,282 you'll pay back 1% of your taxable income annually, which increases incrementally through to 10% for those earning over $137,898.

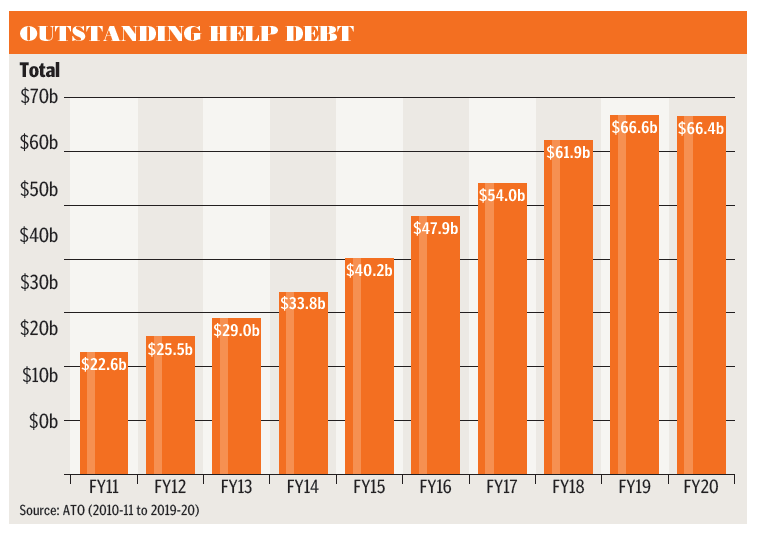

According to the Australian Taxation Office (ATO), almost 3 million people had an outstanding HELP debt at the end of the 2019-20 financial year. The average amount was $23,280, up from $22,425 in 2018-19.

The time taken to repay HELP debts has also been increasing, reaching 9.3 years in 2019-20, up from 9.2 years in 2018-19.

HELP debt is cheap, maybe the cheapest debt you can get. Unlike other types of loans, HELP debt does not incur an interest charge.

But the amount owed does increase. HELP debt is indexed to inflation, as measured by the consumer price index (CPI). CPI is currently 1.1%, next to nothing, so in a way this figure could be treated as the annual interest charge on the loan.

"Paying down a HELP debt has very little merit at all, because the amount that comes out of your pay is very low, and the amount by which that debt grows is negligible," says Nicole Pedersen-McKinnon, author of How To Get Mortgage Free Like Me. Nor will HELP debt affect your credit score.

"But it will form part of getting a home loan because you will have to service that debt at different thresholds."

Financial experts often talk about good debt and bad debt. HELP debt is certainly good debt. Not only is it contributing towards your future earnings, by aiding a career and the money you get from it, but it costs next to nothing.

Weigh the rates

You should work out what position you would be in if you pay down debt versus the position you would be in if you invest that spare cash.

"If we look at it from a return perspective, it comes down to the interest rate," says Elysse Lorenti, a senior financial adviser at Perpetual Private.

"When the interest rate is more than 5%, you're likely to be better off making additional payments on your debt. But if the interest rate is less than 5%, you're often better off to invest your surplus income rather than paying down debt."

Compare that to a diversified share portfolio, which has historically returned around 7% over the past 10 years. In this situation, you can generate a much higher return through investing than you would by paying down debt.

"That return means you can accelerate your wealth faster, and add to that the benefit of compounding year on year," says Lorenti. "You'll generally be in a much better position investing over paying down your HECS debt."

For these reasons, Lorenti suggests using extra cash to first pay off debt that has an interest rate greater than 5%.

However, if it's less than 5%, which HECS debt most certainly is, then it's likely more effective to use any extra cash to invest.

Lorenti reasons 5% is an appropriate threshold to draw the line between the average interest rate of debt and the average interest generated by the sharemarket.

Given that HECS debt is indexed to inflation, which at the time of writing was 1.1%, then it makes financial sense to invest your surplus cash.

"If you invest that money elsewhere, you hope that you stand to gain more than you save," says Pedersen-McKinnon.

Calculating the investment return should also include the tax you pay on earnings.

"You have to factor in that when you earn money, rather than save money. You pay a tax on those earnings, while paying down debt is tax free," says Pederson-McKinnon.

All this is easier said than done. For some people, leaving a big HELP debt alone to instead invest their hard-earned dollars can be challenging.

"A large debt can be scary," acknowledges Pedersen-McKinnon. "But if that large debt is stagnating, you can use your spare money to invest elsewhere."

At the other side of the spectrum is credit card and personal loan debt, which does exceed the 5% threshold.

Upfront discount

The upfront discount was reinstated on January 1, 2021, after being removed in 2017. You will receive a 10% discount if you make upfront payments of $500 or more for units of study with a census date on or after January 1, 2021.

No discount exists for paying off existing debt. It's a one-time offer for current students, hence "upfront".

While the upfront discount may be enticing, Lorenti says the same 5% rule applies. "Most of the time, though, university students don't have a lot of extra cash flow available to be able to do this.

Too much of a burden

Given the choice between paying down HELP debt and investing, it makes sense to do the former rather than the latter. But paying down any debt is still good in itself.

"The amount of the debt can play a part," says Lorenti. "If someone has hundreds of thousands of debt, they might prefer to put that debt behind them."

In this case, paying down a large HECS debt may be a burden worth removing. You will end up with more take-home pay.

"If someone wants more cash flow, more money in their pocket, that's when it might be better to pay off the HECS debt."

Moreover, some people undertook their studies on full fee places. These amounts don't involve any government loan and need to be paid upfront. Often that money is borrowed from family, with an agreed timeline for paying it off.

Paying down a home loan faster is also a good idea. According to National Australia Bank, paying off a $160,000 loan with a 4% interest rate in 30 years will cost you about $115,000 in interest. However, paying it off in 15 years brings interest down to around $53,000, saving just over $61,000.

Habits for success

Choosing the investing path over the debt reduction path also instils good financial habits.

"If you set up an investment plan, you're setting up the habit of putting aside some take home pay for investing," says Lorenti.

Millennials are already ahead when it comes to budgeting.

According to research by UBank, millennials (70%) are most likely to use budgeting tools at least sometimes, ahead of baby boomers (66%), gen X (62%) and gen Z (60%). They're also more likely (56%) than gen Z (46%), gen X (46%) and baby boomers (41%) to have implemented new spending and budgeting strategies in response to how the economy is faring.

Pedersen-McKinnon suggests splitting your investment dollars 50-50 between safe and riskier investments.

"A mortgage is a good way to force financial discipline, because it's a regular commitment you must meet," she says.

If you can't trust yourself to regularly invest, consider borrowing to invest in an asset.

"Investments made young grow to be the biggest," says Pedersen-McKinnon, due to the winning combination of compounding returns and time.

"The sooner you start, the more you'll end up with and the less it will cost you."

Lorenti notes that good financial discipline has aspects of both saving and investing. "When you combine the saving aspect with the investing aspect, that will set you up financially for the future."

She suggests earmarking 20% of your earnings for investment. "Obviously, if you're earning surplus to your needs you can set aside more," she says.

But the investing piece should come into play only once you set up an emergency cash fund to meet unexpected expenses.

"Typically, we recommend having three to six months cash set aside in that emergency fund. Once you have that, you then start investing."

Paying down debt and investing is a personal choice, and one that should take into account your personal circumstances.

But one thing is clear. HELP debt may be one of the only debts you can, and in many cases should, set and forget. Consider investing it instead. Your future wealth will be all the better for it.

Get stories like this in our newsletters.