NEXTDC is one of Australia's most shorted stocks - did it pay off?

By Roger Montgomery

Short selling is a consistent feature of the equity market and much was written earlier this year about Tesla's equity journey with its short sellers. But what about the short selling story at NEXTDC (ASX:NXT), one of Australia's most shorted stocks? Did shorting NXT pay off?

We see NEXTDC as a structural growth story, a play on the $1 trillion (yes, trillion) corporate computing market shifting to the cloud, and we are early in that trend.

NEXTDC is digital infrastructure, backed by high returning hard assets that in the long run we expect to be valued for its stable visible cashflows, like a portfolio of commercial office buildings, but one that holds data centres hosting densely interconnected computing infrastructure powering commerce for today and tomorrow.

NEXTDC is capital intensive, and management has a track record of delivering good sustainable returns backed by long term contracts.

So did betting against this structural growth story make the shorts money?

The data says no. It hurt.

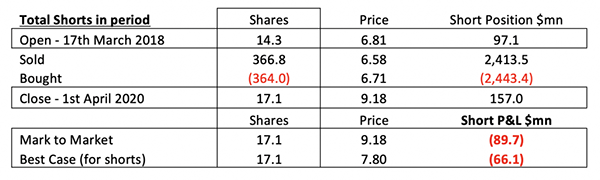

The table above aggregates the daily short volumes, and using the volume weighted average price (VWAP) on each day, we can calculate the aggregate dollar volume or value of the short position.

Over the period concerned the shorts traded over $2.4 billion on both the buy and the sell side as the short base constantly adjusted its position. On April 2, the date of the recent capital raise, there were some 17.1 million shares short.

Even in a best-case scenario (for the shorts), where NEXTDC and Capital Raise underwriters decided to sell the capital raise stock to the shorts (at $7.80) to allow them to cover their short positions it looks like an unprofitable trade.

The price action on the day after the capital raise, where shares gapped to $10 post issuing capital at $7.80, is consistent significant short cover trading, as does the movement in the short position data we can see for April 3. It doesn't look like the shorts got to cover their positions in size in the capital raise. Either way the shorts have had to fund losses to the tune of between $66 to $90 million over the period.

To add injury to insult, the short cover move from October 2019, where it looks like the shorts bought back around 35 million shares net over the period will likely have helped lift NEXTDC's share price.

Did NEXTDC take advantage and raise capital as the shorts covered? Probably. One giant balance sheet re-set on terms favourable to shareholders courtesy of the shorts.

Get stories like this in our newsletters.