Is there more growth left for NBN rival Uniti Group?

Following a recent call with Uniti Group we think there could be some serious runway left to go. Uniti adheres to a sales-led capital expenditure (capex) program. This means that it doesn't invest capex on speculation. Instead, it installs internet fibre infrastructure when the client pays for it.

Obviously, this has some implications for future analysis of the accounts but from a business owner's perspective, having your clients pay for growth capex is pretty handy because each site and the business becomes cash generative early.

Uniti offers a bunch of internet services and arguably the most important is the installation of fibre networks on, and connection to, broadacre development sites, Multi Dwelling Unit (MDU) developments and brownfields.

Post its acquisition strategy, Uniti has effectively become the only competitor to the NBN. When it's done, the company claims it will have a fully funded fibre network covering a great swathe of western Sydney.

One can imagine a vast network of connected homes could be an important strategic asset for another telco or a great cashflow generator for a pension fund looking for a reliable income stream. But of course, that's pure speculation at this stage.

Importantly, the company notes that the acquisition phase of its strategy is now complete, and Uniti will now focus on Integration, Growth and building Capability. In other words, it is now pivoting to organic growth.

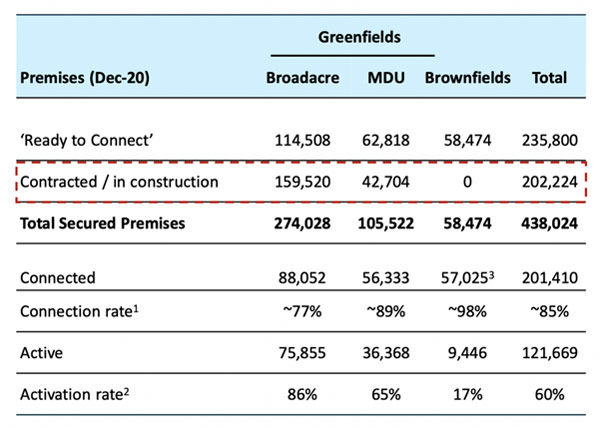

Table 1., which is from the company's HY21 presentation, shows where the company's confidence in its future revenue streams comes from.

More than 200,000 premises are contracted to be connected, which will significantly increase revenues, especially if increasing internet usage leads consumers to purchase higher speed subscriptions.

Obviously, the 'visibility' of earnings and cashflows is improving. The company knows how many buildings are connected and will be connected, and consequently the business is delivering sustained organic growth in annuity revenue. Only 10.5% of second half FY21 revenue will be of the 'one-off' variety.

We estimate the company could see active services on its owned fibre infrastructure double in less than five years just from the existing contracted order book.

Revenues could double in five years, and at a 70% EBITDA margin.

In other words, 70% of current revenue could be added to existing EBITDA in five years. Estimated FY21 EBITDA is about $116 million, and the revenue run rate is about $200 million. So, in five years an additional $140 million of EBITDA could be added to the current $116 million, which would correspond to 17% annualized EBITDA growth.

Get stories like this in our newsletters.