Where the mega-rich actually invest

By Nicola Field

Who the tax office is targeting, new platform to stop scammers in their tracks, and the one investment the mega-rich love. Here are five things you may have missed this week.

Where the mega-rich invest

There's rich. And there's seriously rich.

The latest Frank Knight Wealth Report lifts the lid on where ultra high net worth individuals (UHNWIs) - people worth at least $US30 million ($A45 million), choose to invest their money.

According to the report, the combined effects of inflation, the conflict in Ukraine and rising interest rates saw the total wealth held by UHNWIs shrink by 10% during 2022, a drop of $US10 trillion. How awful for them...

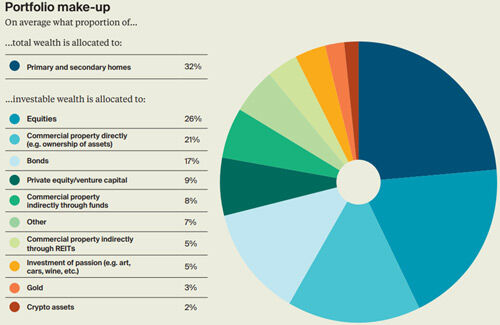

When it comes to their preferred choice of assets, the super-rich have, on average, around one-third (32%) of their wealth tied up in their homes (note the plural), followed by shares (26%).

What's surprising is that commercial property plays a key role in the portfolios of UHNWIs.

Directly held commercial property (21%) plus investments in property funds (8%) and real estate trusts (5%) mean commercial property can account for 34% of wealth allocation, potentially making this number one asset class for the ultra-rich.

ATO targeting landlords this tax time

The Australian Taxation Office (ATO) has announced that its three key focus areas for tax time 2023 are:

- rental property deductions

- work-related expenses, and

- capital gains.

ATO Assistant Commissioner Tim Loh says these are areas where mistakes are often made.

Landlords be warned, in a review of tax returns the ATO found nine out of ten rental property owners got things wrong, often leaving out rental income, overclaiming expenses or claiming for improvements made to private properties.

The ATO will also be looking closely at claims for mortgage interest on a rental property, especially if a loan was refinanced with part of funds going towards personal spending.

Loh says, "Don't forget, if your loan includes a private expense, such as for a new car or a trip to Bali, you can only claim an interest deduction for the portion relating to producing your rental income."

Workers are being urged to avoid cutting and pasting work-from-home deductions from last year's tax return.

"There have been some changes in how you calculate things like working from home deductions, so don't be tempted to just copy and paste your prior year's claims," says Loh. "We know a lot of people are working back in the office more compared to last year."

If you've made a profit on the sale of assets such as shares or crypto, be sure to include any capital gains in your tax return.

Loh issues a grim warning, saying, "Don't fall into the trap of thinking we won't notice if you sell an asset for a gain and don't declare it."

New platform to help halt payments to scammers

This week saw the launch of the new Fraud Reporting Exchange (FRX) platform designed to speed up the reporting of fraudulent or scam payments while they are enroute to another bank.

The idea is that banks will be able to report scam payments in near-real time, boosting the likelihood that funds can be frozen and returned to customers.

Anna Bligh, CEO of the Australian Banking Association, says, "Given every minute can be crucial in disrupting scams, the launch of the FRX is a major development. It means more and more scammers are going to hit a brick wall."

So far, 17 banks have signed up, or are in the process of joining the FRX.

However, the onus is still on consumers to contact their bank immediately to report a scam payment.

"The sooner that banks know about a fraud, the sooner they can take swift action to try to halt the payment before it gets to the scammers," says Bligh.

We're cutting spending - just not where expected

Ask any economist and they'll tell you that when times are tough, 'discretionary' spending -purchases of non-essentials, is the first thing to be cut.

But that's not happening right now.

CommBank's latest Cost of Living Insights report shows discretionary spending remains high post-Covid, while spending on essential items is barely growing in line with inflation.

The report says we're being thrifty in areas of everyday spending to prioritise on experiences, notably travel and accommodation.

The report's author, CommBank iQ Head of Innovation and Analytics, Wade Tubman, says "We're responding to the increased cost of living in diverse and sometimes unexpected ways."

He agrees that cost of living pressures make it seem counter-intuitive for consumers to boost their discretionary spending, but adds, "What we're seeing is a continued Covid rebound effect, with consumers catching up on the experiences that they missed out on during the pandemic."

Op shop buy dishes up 300,000% return

They're not called opportunity shops for nothing.

A UK op shopper, who picked up a pair of Chinese jars for just £20 ($A37) from a charity store, has pocketed a tidy profit of £59,780 ($A112,000).

The vases were sold this week by auction house Roseberys, with the hammer falling at £59,800, beating the expected result of £30,000-£50,000.

It turns out the jars are rare 18th century Qing dynasty porcelain.

The seller suspected they could be worth a quid or two given the unusual 6-character seal on the base of each jar instead of the more typical "Made in China".

It's not the first time unloved treasures have netted their owners a fortune.

In 2018, a vase from the same Qing dynasty, which had been tucked away for years in a shoebox by a French family because no one liked it, sold at auction for €16.2 million ($A26.4 million).

Get stories like this in our newsletters.