Ask Paul: We have $300k in the bank and don't know what to do with it

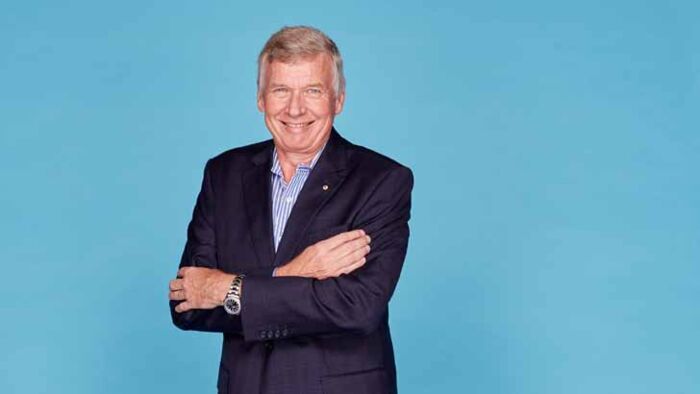

By Paul Clitheroe

Hi Paul, I'm hoping for some help because I'm a super-frustrated individual at the moment, not overall, just relative to the following situation.

I am 49 years old. Our house has been paid off for about three or four years now.

As I am quite a conservative sort of guy, I tend to save money rather than blow it all.

So for a number of years I have continued to pay the mortgage, so to speak, into a savings account and on top of that I put further savings away where possible.

So I now have $300,000 sitting idle in an account.

It kills me to think that I have wasted so much time and possibly missed out on compounding the growth of our savings and yet I still do not know what to do with the money: buy a house and rent it out, exchange traded funds, etc.

I need to get something in place so I can stop worrying about it.

Any words of wisdom would be much appreciated. - Clint

G'day Clint, and welcome to the "problem" in this most unusual time in history.

First, though, congratulations on paying off your mortgage and then continuing to save, plus a bit. The fact that you "save money rather than blow it all" is the real secret to wealth creation.

We all hear plenty of get-rich-quick ideas and any number of people telling us how rich we would be "if only we had" invested in property or shares years ago, or backed Twilight Payment, the winner of the last Melbourne Cup. But the world of success with money does not belong to the dreamers; it belongs to those who create surplus capital by saving and then investing it wisely.

Now, back to the "problem" of today. Basically, the world is awash with cash. Our banking system, along with banks around the world, simply cannot lend the vast pools of cash they hold.

With our Reserve Bank buying back government bonds and also providing very low-cost loans to lenders, plus the fact that billions of dollars are being poured out via all sorts of pandemic relief, our banks are flush.

As Shayne Elliott, CEO of ANZ Bank, said late in 2020: "There is all this liquidity flushing around" but "people don't want it". He went on to say, quite correctly, that money is essentially free today.

Pretty obviously, ANZ, or any bank, would have a large queue if it was handing out free money. What he is referring to is that Covid-19 has made individuals very cautious. So we put rainy day money in the bank.

Add this to the additional money many are not spending on travel (in 2019 Australians bought 11 million return airfares), the inability to go out during lockdowns, closed interstate borders, and a very restricted 2020 and you get a very large pot of money waiting to go somewhere.

Your money, like that of so many other people, sits there wondering about the future.

Incidentally, I should say that some of our money is sitting with yours, earning next to nothing in interest as we also ponder the future. For us, though, spare cash earning very little is a necessary part of our lives. I turn 66 this year and one thing I do know is that investment risk is mitigated by time and we have less of that.

Also, as we move into semi-retirement, it is important to hold rainy day money. We will continue to get market ups and downs, and the last thing we need is to find ourselves in a downturn needing to sell assets to fund our lifestyle.

But you are in a very different position. At 49, I imagine you have many years left in the workplace and the ability to keep saving. My question to you is quite simple: do you think property and shares, our most obvious investment areas, are likely to be worth more or less in, say, 20 years?

My view is they will be worth more.

This I base on one simple fact: demand. Demand is created by individuals and families. If I felt our population would fall over the next two decades, I would be reluctant to own property anywhere but in our most dynamic job growth areas. You would need to choose shares with caution.

However, barring a really dreadful event, such as the bubonic plague of the 1340s, which is said to have killed up to half the population in places such as Venice, or our planet being hit by an asteroid, the most commonsense prediction is a growing world population. In Australia, our population is predicted to grow by another 10 million or so over the next 30 years. Our biggest cities, Sydney and Melbourne, are predicted to each have a population of more than eight million.

So while I have no idea what will happen next with our COVID-19 crisis, one thing history tells me is that we and our economy will recover. Markets are pretty hot and we are sure to get some lumps and bumps along the way, but with a long-term view I agree you should invest that money.

First, I'd top up your super via salary sacrifice with the maximum concessional contribution of $25,000 a year ($27,500 from July 1). Iam sure you are in a large, low-cost fund, but do check its performance.

Then I cannot call the next decision for you.

Frankly, I am pretty unfussed whether you buy a well-located investment property or buy shares via a low-cost ETF or manager such as Vanguard. I do support diversification so, as a homeowner, diversifying into shares makes a lot of sense. Well-located property and shares are both likely to do well over the decades. Historically, cash is likely to be your worst asset.

Get stories like this in our newsletters.