Aussies to spend $6.2 billion on Black Friday sales

By Nicola Field

Black Friday to fuel $6.2 billion spending spree, finances cause friction for one in five relationships and ASX scraps CHESS replacement. Here are five things you may have missed this week.

Australians expected to spend $6.2 billion on Black Friday sales

With a week to go before the Black Friday/Cyber Monday sales, the Australian Retailers Association (ARA) expects spending to reach a record $6.2 billion over the four-day weekend - happening Friday 25 November to Monday 28 November 2022.

ARA says around 25% of Christmas shopping is completed in Black Friday week alone, but the best savings can be found during Cyber Week when discounts average 22%.

ARA CEO Paul Zahra, says, "We know many people are more conscious about their household budgets with the cost of living going up, so the Black Friday sales are an ideal time to complete Christmas purchases, save money and ensure gifts are delivered on time."

Despite rising interest rates, Zahra says retail sales overall are currently "at record levels", with pre-Christmas sales forecast to reach nearly $64 billion - a 3% increase on last year.

Money creates relationship problems for one in five

Relationships Australia has just released its latest Relationships Indicators report, which shows money problems are a leading cause of pressure in relationships.

One in five relationships are impacted by financial issues, and as more of us grapple increased living costs, that figure could rise.

Relationships Australia offers five tips for dealing with financial stress in a relationship:

- Start a conversation - let your partner know you'd like to talk about finances and set a time to talk.

- Understand what money means to you - our views on money are shaped by multiple factors from culture to upbringing. Discovering what money means to each other can help you move forward.

- Know what you spend - consider tracking joint expenses for a month, then sit back down together and discuss the results.

- Set boundaries - work out how you'll share expenses but accept there may be some money matters you'll never agree on.

- Consider professional help - don't wait for a full-blown financial crisis to get help. Many relationship counselling services are available for very low cost.

ASX heads back to drawing board for CHESS replacement

Five years after announcing the replacement of the sharemarket's CHESS clearing and settlement system with blockchain technology, the ASX is scrapping the project.

Citing "significant challenges with the solution design", the ASX will write off $245-255 million as a result of shelving the project. This will have no impact on dividends according to the ASX.

Finding a suitable CHESS replacement has been a drawn-out affair, and ASX Chairman Damian Roche apologised to shareholders for "the disruption experienced in relation to the CHESS replacement project over a number of years."

In the meantime, it looks as though CHESS could be with us for some time.

ASX Managing Director and CEO Helen Lofthouse, says, "We have increased our investment in the capacity and resilience of the existing system, and are confident it will continue to serve the Australian marketplace well into the future."

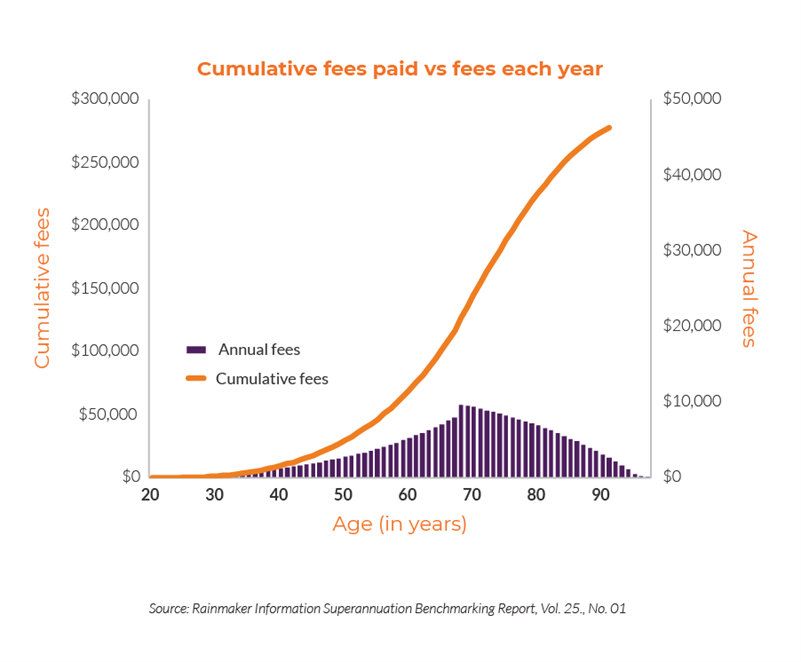

Retirement is when we pay most of our superannuation fees

Most retirees will pay more in super fees during retirement than they would during all the years they were in their accumulation phase, according to research from Rainmaker Information.

While a typical fund member will earn almost half of their lifetime investment returns during retirement, they will also pay 55% of their lifetime fees over that same period.

Alex Dunnin, executive director of research and compliance and Rainmaker Information, says, "While so much focus has been on the fees paid by fund members in their working life, the fact is that fund members will pay the biggest proportion of their total lifetime fees after they retire."

This highlights the need for Australians in or near retirement to take a closer look at their fund's fees in the drawdown phase.

Australian superannuation members paid $31 billion in investment fees in the year to 30 June 2022, with the average fee ratio dropping from 1.01% to 0.95% over the last year.

Australians really do try to 'keep up with the Joneses'

Loving your shiny new car? Chances are the neighbours are eyeing it off also.

Reserve Bank research shows middle-aged, middle-income households are kept busy keeping up with the Joneses.

The study found these households try to close the income gap with those around them by taking on investment debt, while closing the consumption gap by accumulating more car debt.

This is consistent with separate research showing one in ten Australians succumb to peer pressure by making expensive purchases such as a nice car, home or designer items.

Psychologists say humans subconsciously look at those around them for confirmation of their own social and economic status. While a peacock fluffs his feathers, humans flaunt their material possessions.

But it could be a losing battle. Taking on more debt can just make it harder to achieve personal financial goals.

Remember too, a neighbour who appears to have it all could also be knee-deep in hock.

Get stories like this in our newsletters.