'My focus is financial independence, not early retirement'

By Susan Hely

Three years ago we first profiled seven Aussies who are working towards early retirement.

Money caught up with them again to find out how their plans and investments have fared during COVID-19.

Read more about the early retirees who know there's more to life than work, and how to be inspired by the FIRE movement.

NAME: Jason*, 48

AIM: Retire in 15 months

INCOME NEEDED: $90,500

INVESTMENT STRATEGY: Vanguard

Jason has been on the retire-early journey for 20 years and is on the verge of deciding whether to leave his well-paid corporate job. He is in his late 40s.

In just over a year he estimates his investments and savings will reach $2.58 million, which will give him a healthy income of $90,500 a year, based on a conservative 3.5% yield, reduced from 4% in 2018.

Four years ago Jason reached a "lean" retirement target based on th

"I personally define FIRE more as reaching the point where income generated from a portfolio of passive investments can meet my current normal living expenses, giving greater choice about how - or even whether - to work," he says.

"Just like many pursuing FIRE, my main focus is on the financial independence element, more than the retire early part."

Exploring different paths and investments is what Jason's popular and enlightening blog, thefiexplorer.com, covers.

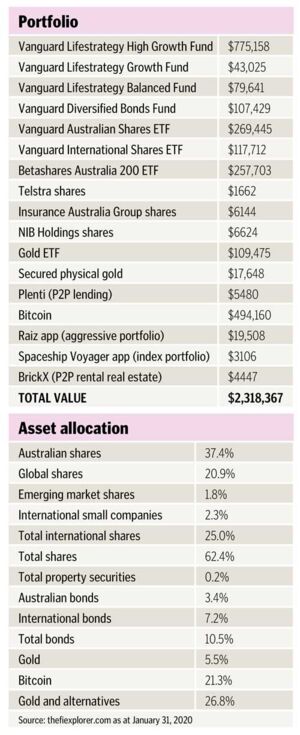

Since we spoke to him in 2018, Jason's retirement savings have jumped by $1 million to reach $2.3 million. Why did they go up so much?

Most of his investments edged higher but two, in particular, soared: Bitcoin and gold.

Jason is curious about different sorts of assets, so he took the plunge and bought small amounts in addition to his main holdings of Vanguard index funds and some direct shares obtained when private companies went public and offered loyal customers shares. His shares amount to $1.4 million.

As well as gold and Bitcoin, Jason put some money on the Acorns app and added some peer-to-peer lending. His gold holding jumped from $77,905 to $109,475 in four years. He bought Bitcoin in 2015-16 as an experiment when it was worth several hundred dollars per coin. It had soared to about $55,900 at the time of going to print. At the end of January, his Bitcoin holding was worth around $494,160.

While many investors would have been tempted to sell, Jason is a long-term investor and happy to keep it sitting in his portfolio. "This has grown to become an unexpectedly sizeable portion of the portfolio, but there is also always the possibility it will fall back," he says.

Dividends keep growing

With more capital invested in shares comes a steady growth in the level of distributions as a proportion of his monthly spending needs.

"In 2018, there was a significant gap of more than $2000 per month between recent average distributions and total spending. Three years on, that gap is down to below $1000 a month," says Jason.

Crucial to his saving plan was buying an affordable house and not upgrading as his income went up. "Plus paying off the mortgage as quickly as possible and regular saving and investing."

The FI Explorer's tips

The key to Jason's accumulation of capital is automatically investing around 60% of his salary from his corporate job, including any raises or bonuses. Once the money is saved, the investments do the heavy work of growing.

Favourite reading

- Atomic Habits: An Easy & Proven Way to Build Good Habits & Break Bad Ones by James Clear

- Nick Maggiulli's blog: ofdollarsanddata.com

- Safe Withdrawal Rates, an extended series at the US blog earlyretirementnow.com.

*Not his real name

Get stories like this in our newsletters.