King Charles won't appear on the new $5 note

By Nicola Field

$5 note gets an overhaul, where to earn 10% returns in 2023, and 1 in 8 fudge home loan applications. Here are five things you may have missed this week.

Change for a fiver?

The Reserve Bank has decided to update the $5 banknote to feature a new design that honours the culture and history of the First Australians.

Instead of the late Queen Elizabeth II - or her successor King Charles III - staring at us from a $5 note, we can expect a new look for the humble fiver, developed in consultation with First Australians.

The Reserve says the new banknote will take several years to be designed and printed. In the meantime, the current $5 note will continue to be issued, and can still be used even after the new note is launched.

Should we start hoarding $5 notes as possible collectibles? No. Reserve Bank data shows there are over 200 million $5 notes circulating in the economy, so they're certainly not scarce.

The new design won't please everyone. More than 2000 Australians petitioned the Federal Parliament to have Steve Irwin on the $5 note. Other suggestions included Olivia Newton John, Cathy Freeman and Kylie Minogue.

Emerging markets forecast to deliver 10%-plus returns

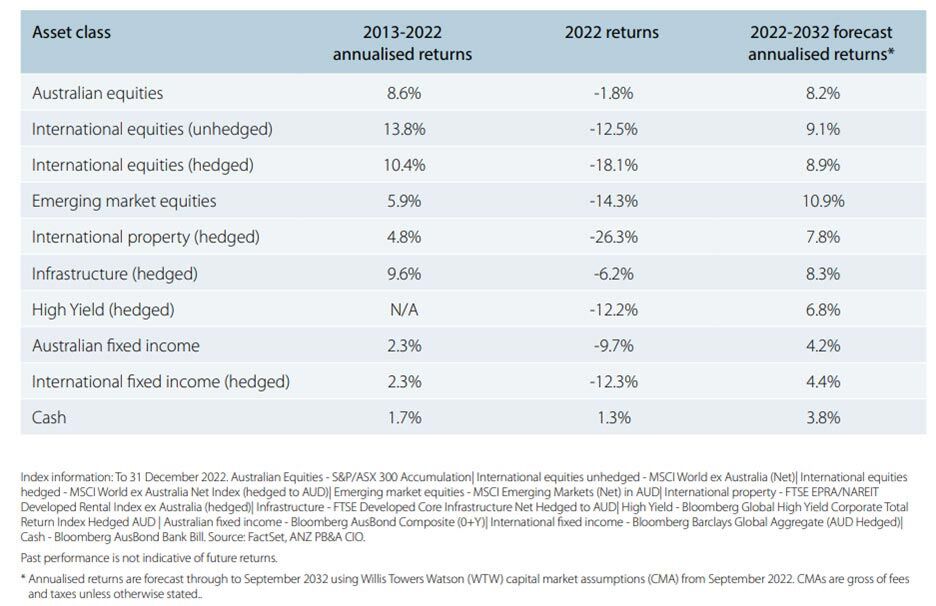

ANZ Private Bank has released its 2023 Global Market Outlook, which forecasts returns for key investment markets in 2023.

Lakshman Anantakrishnan, ANZ Private Banking Head of Investment Strategy, says, "While the macro-outlook will remain challenging, unlike 2022 there should be ample opportunity for investors this year."

The report points to emerging market equities as a likely contender for the highest returns of 2023, with gains of 10.9% predicted. That's followed by international shares (hedged: 8.9%, unhedged: 9.1%) and Aussie shares (8.2%).

If the forecasts prove right, 2023 could be a major turnaround from last year when sharemarkets took a bath in the red.

Liar loans: One in eight fib on mortgage application

One in eight homeowners - about 429,000 mortgage borrowers, have told a few porkies in order to land a home loan, according to research by Finder.

Details about personal savings were most likely to be falsified by borrowers, though plenty also gilded the lily on income and personal debt details in their home loan application.

Finder's Richard Whitten says stretching the truth during the home-buying process can be a recipe for disaster.

"While small inaccuracies may not be the end of the world, if a lender finds a big discrepancy in the figures you've given them or you've outright lied about your financial position, the consequences could be severe.

"Home loan contracts typically contain wording around providing misleading or incorrect information to a lender. In the worst case, lying on a mortgage application is grounds for a default event, meaning the lender could sell your property."

Legality aside, Whitten adds that lying on a loan application can put borrowers in a risky position if it means borrowing more than they can afford.

Two out of five home buyers look for friends with benefits

Two out of five young Australians aren't waiting for a life partner to share the home-buying journey. Instead they're getting into the market with someone other than a romantic partner.

According to a NAB survey, 41% of buyers aged 18 to 29 are prepared to compromise on how much they spend to buy a property, and 40% are considering buying with another person

NAB Executive - Home Ownership, Andy Kerr, says, "Younger Australians aren't letting meeting a partner or getting married later in life hold them back from owning a home now.

"People are definitely looking at their options and casting the net wider when thinking about who they could buy with."

Rentvesting - purchasing in one location and then renting in another - is another trend Kerr says is creeping up in popularity.

"Our data shows that first home buyers aren't being deterred from entering the property market, despite the market softening overall and rising cost-of-living. Buyers are just thinking outside of the box to make it happen," adds Kerr.

60% of Australians throw away money

Australia's cost-of-living crisis shows no signs of slowing, yet research from Compare the Market shows close to 60% of us are tossing away cash just by buying stuff we don't need.

Close to half (43.7%) admit to wasting food, while one-third say they order too much takeaway food.

Over one in 10 people are paying for things they could easily do themselves.

Compare the Market's Chris Ford says the findings are worrying, especially with prices continuing to rise.

"Many Australians know that they're spending money on things they don't need or aren't maximising the savings that are available to them," notes Ford.

"Whether you resist the urge to order takeaway meals from food apps as often, shop during sales or only purchase groceries you'll use, you could end up with more money in your pocket or savings account. It's shaping up to be an expensive 2023 and every cent counts."

Get stories like this in our newsletters.