Why do women pay more for income protection insurance?

By Susan Hely

Why is there a huge difference between what women and men pay for their income protection insurance?

Insuring your income in case you get sick or have an accident is arguably the most important insurance to take out.

But don't expect gender equality from insurance companies. How much you pay depends on whether you are male or female.

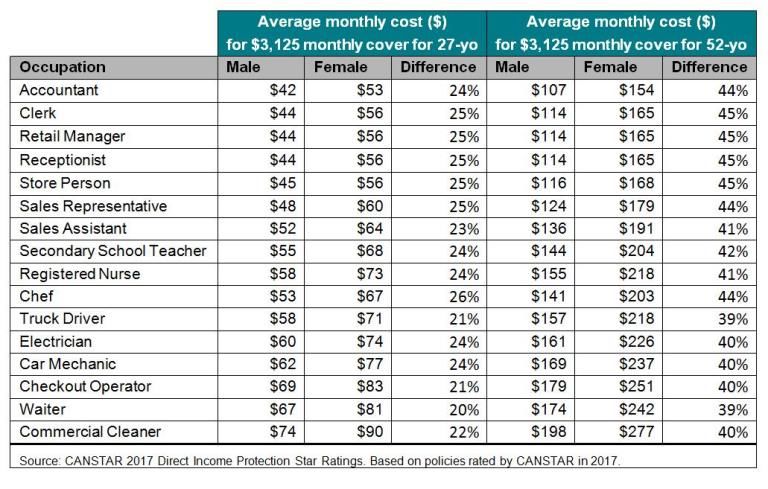

Income protection (also known as salary continuance) insurance is 32%, on average, more expensive for women, according to research house, Canstar.

Take the case of a 27-year-old non-smoking male chef, Sven, with a monthly benefit of $3125 (based on 75% of a $50,000 annual income).

Sven will pay an average monthly premium of $53, while the same policy for Lisa; a female chef of the same age is 26% higher at $67. Or a 52-year-old male secondary teacher, Jack, wanting $3125 per month will pay an average of $144 while Joan, a female teacher will pay $204 per month or 42% more.

Why is there such a big difference in premiums?

"There are a number of factors relating to women's health that make females' income protection policies more expensive," explains Mitchell Watson, Canstar research manager.

"As with all insurances, income protection insurance premiums are determined by the level of past claims history, with females traditionally making more claims than men. A higher volume of claims by women generally mean a higher cost of premiums for women across the board."

According to insurers, a higher volume of claims by women is for reasons relating to:

- Pregnancy and birth related problems

- A higher likelihood than men in the same occupation of suffering musculoskeletal problems

- A higher propensity to mental and emotional illnesses

- Consideration that the cancers women are prone to typically strike earlier than those that men are prone to and a time when earning a living is an issue.

Some 531,800 Australians experienced a work-related injury or illness in 2013-2014, according to the Australian Bureau of Statistics, and 61% had to take time off work.

Many Australians take out income protection insurance through their superannuation fund or directly from the provider while others get advised income protection insurance from an expert. The monthly benefits are typically around 75% of your regular salary.

"However you buy it, make sure you know what you're signing up for," advises Watson.

"If you are looking for direct income protection cover, you want to choose the insurance that provides outstanding value for you," he says.

CANSTAR recently rated 15 direct income protection insurance policies from 13 providers and awarded two, a five-star rating. They are NobleOak and Virgin Money.

Get stories like this in our newsletters.