New Qantas credit card fails to deliver high points

By Sharyn McCowen

The credit card rewards drought has hit Qantas, with comparison site Mozo.com.au finding the airline's new card fails to deliver on its "high points" promises.

The Qantas Premier MasterCard is the latest card to come out since it was announced that interchange fees - the $2 billion source of revenue which lenders draw on to fund most credit card rewards programs - will be capped by the Reserve Bank from July 1.

Mozo ranked the card 26 for net value out of 43 rewards cards earning Qantas points, and found cardholders will be $300 worse off compared with the market-leading card.

The site evaluated Qantas Frequent Flyer rewards cards using the average annual credit card spend of $18,000, and found the Qantas Premium MasterCard, launched on June 5, could deliver just $70 in net annual rewards value once the annual fee is taken into account.

"Qantas's new Premier MasterCard fails to take off for the average cardholder, ranking just 26th in our comparison of Qantas Frequent Flyer rewards cards and earning up to $300 less rewards value each year than the top-ranked American Express Qantas Discovery Card," says Mozo director Kirsty Lamont.

"There's better news for big spenders with Qantas's new card at least making the top 10 for those swiping $60,000 a year. However, the so-called Premier MasterCard is still far from first place with Qantas delivering $464 less value than the top-ranked American Express Qantas Ultimate Card."

The average cardholder spending $18,000 a year on the Qantas Premier MasterCard would earn 1.13 Sydney-to-Melbourne return flights.

"The new card comes at an interesting time in the rewards card landscape with many banks slashing the value of rewards programs as regulations kick in around interchange fees and increase the cost of funding rewards cards," says Lamont.

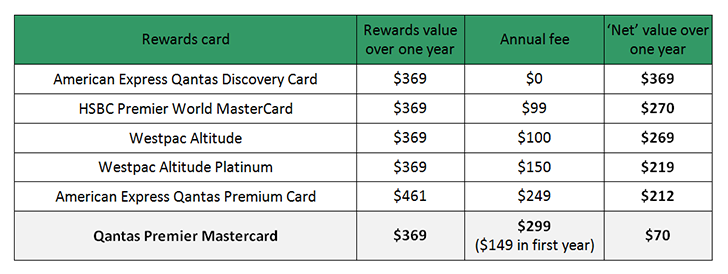

How the new card compares with the best value Qantas Points-earning cards

Source: Mozo.com.au. 'Net' value is derived by calculating how many points would be earned based on an average annual domestic spend of $18,000, then calculating how many Syd-Mel return flights can be redeemed using these points. Net value was calculated using the value of these reward flights (assuming a Syd-Mel return flight valued at $328) less annual fee.

While some rewards cards providers are turning to airport lounge visits and free flights to retain customers in the face of declining rewards, Qantas "has taken a somewhat miserly approach", she says, offering two lounge invitations each year and a discount on selected domestic fares.

The Qantas Premier MasterCard, issued by Citi, has an annual fee of $299 ($149 in the first year) and an interest rate of 19.99%.

Get stories like this in our newsletters.