Gen Z is sacrificing romance to save

By Nicola Field

CEOs earn 55 times average pay, Gen Z slashes spending on dating apps, and equities blitz returns in 2022/23. Here are five things you may have missed this week.

Young Aussies slash spending on dating apps

Younger Australians are making significant adjustments to their spending habits, particularly in the realms of dating and subscriptions.

Research by ubank shows Gen Z has slashed spending on dating apps by 43.7%, closely followed by millennials, who have cut dating app spending by 40.9%.

That's not to say these generations are living like hermits.

Andrew Morrison, chief product and growth officer at ubank says, "Every generation is feeling the cost-of-living crisis, but Gen Z is unique in what it's choosing to spend its money on."

While most generations are looking for ways to save on groceries and eliminating recurring costs like subscriptions and gym memberships, Morrison says younger Aussies continue to spend on the things that make them feel their best - such as travel, concerts, and self-care.

He explains, "After years of being forced to stay at home, missing out on building connections with school friends and loved ones, Gen Z's approach to managing their finances is reflective of their affinity for 'soft living', prioritising experiences that enrich their lives and allow them to be the best version of themselves."

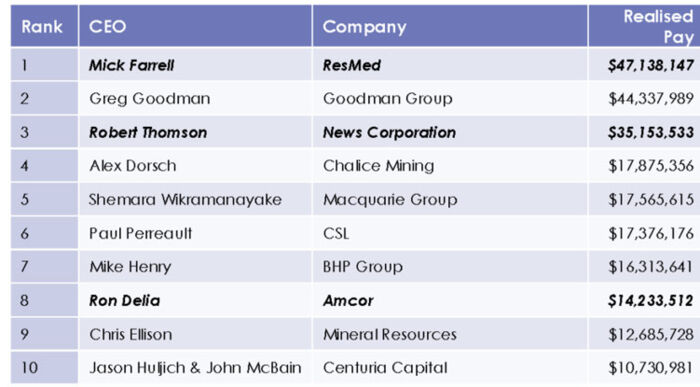

CEOs pocket pay 55 times average adult earnings

A new report from the Australian Council of Superannuation Investors (ACSI) shows CEO of ASX 100 companies received pay packets last year that were, on average, equal to 55 times average adult earnings.

CEOs of ASX 200 foreign domiciled companies took home an average of about $11 million in 2022. Local chief executives had to soldier on with average pay of $4.17 million.

For context, full-time adult average ordinary time earnings were about $93,860 last year.

ResMed's Mick Farrell headed the list of top earners across ASX 200 CEOs, with realised pay - cash plus equity - of $47 million in 2022.

With the company reporting season kicking off in a few weeks, investors will be watching closely to see if CEOs are earning their keep.

Ed John, ACSI's executive manager of stewardship says "Investors look for any bonuses paid to executives to be linked to the delivery of value to shareholders over the long term.

"If performance is down in 2023, we expect to see bonuses follow."

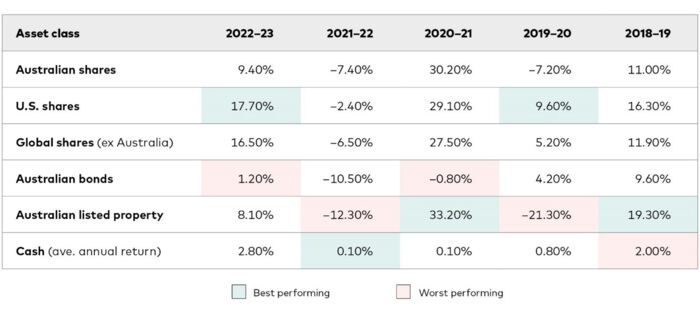

Shares top returns for 2022/23

Analysis by Vanguard confirms that equities lead the field for investment returns in 2022/23.

After falling more than 10% in 2021-22, Australian shares (as measured by the ASX 300 Index) regained almost all their lost ground, climbing 9.4% over the last financial year.

It was an even stronger 12 months for US shares. The S&P 500 Index fell more than 11% in 2021/22, but rebounded by 17.7% in 2022/23.

Past returns are no guide for the future, but investors benefited from positive returns across almost all the major asset classes in 2022/23.

A notable exception was residential property. CoreLogic data shows values dropped 5.3% nationally over the 12 months ended June 2023.

French repair bonus aims to cut fashion waste

Australians could take a lead from the French when it comes to fashion.

It's not that we have daggy wardrobes. It's more about our throwaway attitude to garments.

The Fashion Council of Australia says we each buy an average of 56 items of clothing annually. Yet 200,000 tonnes of garments end up in landfill each year.

A similar problem exists in France. That's seen the French government launch a "repair bonus" aimed at encouraging consumers to mend clothes rather than bin them.

From October the bonus will be worth between €6 ($9.80) and €25 ($41) per repair.

No such scheme exists in Australia, but it is possible to turn unwanted threads into cash instead of trash.

Selling site Gumtree says unused or unwanted clothing is one of the platform's most commonly sold items.

A bit of wear and tear may not be a problem when "distressed" and "torn" jeans are selling for $500-plus at major department stores.

NAB's simple step to boost security

In an Australian banking first, NAB is stopping the use of links in unexpected texts to its 8.5 million customers in a major crackdown to reduce the impact of scams and fraud.

NAB CEO Ross McEwan says the bank is 95% of the way through removing the use of links in unexpected text messages and was aiming to complete the project by the end of July.

"Our aim is to make it as simple as we can for customers to know whether a message from NAB is legitimate," says McEwan.

"My advice is don't click on a link. If you get an unexpected text message that looks like it's from NAB and it contains a link, don't click on it."

Get stories like this in our newsletters.