Auckland International Airport to take off

By Michael Wayne

Auckland International Airport (AIA) is the largest airport in New Zealand. AIA provides airport facilities and services as well as corresponding infrastructure for commercial airlines, freight and logistics. In an average pre-COVID year, the airport services 21 million passengers per annum.

AIA sustains competitive advantage through its diverse revenue channels, made up of six primary categories, these include aeronautical, retail, transport, property, hotels, and its investment in Queenstown (as part-owner of Queenstown airport).

AIA has come under huge pressure created by the ever-evolving COVID-19 environment.

However, we expect AIA to experience the same strong recovery in air travel overseas markets have seen. In October 2022 the NZ border is scheduled to reopen and normal visa processing resumes for all visa categories.

AIA has utilised the downtime, cutting costs and investing in infrastructure to ensure it is prepared to leverage the scheduled opening in October.

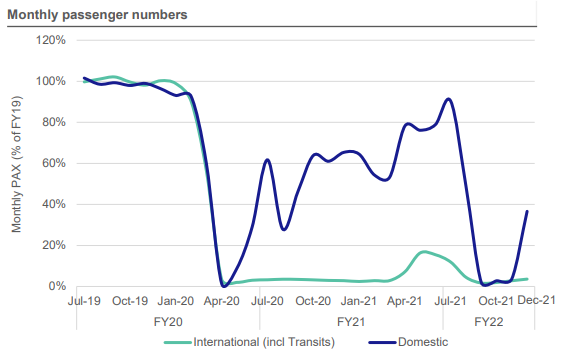

Passenger numbers continue to be impacted by COVID

The Delta and Omicron variants have had a significant impact on the resumption of airport operations in 1H22. The imposition of domestic and international travel restrictions resulted in significantly reduced passenger numbers for the first six months of the year.

In March AIA's total passenger volumes were down 77.2% compared to the pre-COVID equivalent in March 2019. Compared to March 2021, international passengers were up 330.1%, transit passengers were up 157% and domestic passengers were down by 34.5%.

These numbers illustrate the stop-start nature of New Zealand's international travel opening which has hindered AIA's operations.

We are confident however the recent border announcement should enable a gradual recovery in international travel over calendar 2022. AIA's strong management team and investment in key infrastructure throughout the last two years, places confidence in our belief they will be poised to leverage the opening and eventual return to normalcy.

FY22 interim results

Total number of passengers decreased to 1.7 million for the half, down 39% on 1H21. As a result of this reduction revenue was down 4% to NZ $126 million. NPAT was up 274% to $109 million, bolstered by a $132 million non-cash investment property valuation uplift. AIA sustained an underlying net loss after tax of $11.5 million.

Property development and infrastructure opportunities

Medallion we continue to like the upside potential which comes with the not only the return of the airport to pre-COVID levels but also the property development and infrastructure opportunities available for AIA. Unlike Sydney Airport, AIA own the airport land and surrounds.

This provides the ability to not only improve and expand the airport itself, but also to continue growing and investing into the airport's property business.

In the six months to December 31, 2021, Auckland Airport completed $33 million in roading improvements to its 40km core roading network, widening and creating new roads, adding high occupancy vehicle lanes, and improving pedestrian and cycle paths. On the airfield, a further $28 million in upgrades were carried out to pavement, ground lighting and the underground fuel network.

Further infrastructure plans include a new NZ$350 million arrivals area at the international terminal and an alliance to accelerate the new Domestic Jet Hub - a $1 billion terminal to be connected to the international terminal.

AIA's property business continues to grow effectively, with occupancy remaining at 98.5% and a solid development pipeline from both new and existing tenants. Design and pre-development planning is underway for the 100-store fashion outlet centre to be built on the northeast edge of the airport precinct.

Outlook

Overall, we see AIA as a business poised to leverage a rebound in international travel.

While the business has been hammered by COVID-19 and ongoing lockdowns, AIA is in a strong position to capitalise on a reopening. AIA represent a sound opportunity to acquire a low-risk, value-orientated business in these tumultuous market conditions.

Get stories like this in our newsletters.