Why women-led super funds continue to outperform

By Karren Vergara

New research shows superannuation funds with females holding an executive position continue to outperform male counterparts.

Of the 50 super funds analysed in the annual W-Index from Rainmaker, publisher of Money, one-third of leadership roles such as chairs of the board and committees, trustees and chief executives are held by women.

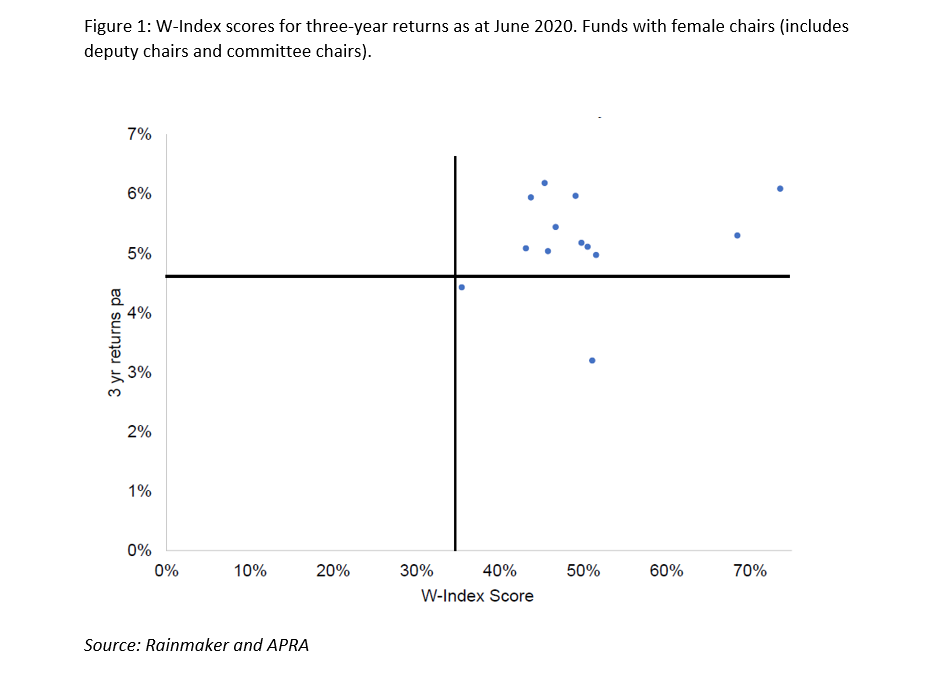

Interestingly, 11 out of the 13 funds that had an above-average proportion of women in leadership roles outperformed in the three years to FY20.

Figure 1 highlights the 13 funds: Tasplan, Vision Super, Media Super, Cbus, Statewide Super, CareSuper, Commonwealth Superannuation Corporation, BUSSQ, legalsuper, Club Plus, TelstraSuper, ESSSuper and REI Super.

Using APRA's June 2020 data, Rainmaker also delved into the demographics to see which funds have the highest number of female members; young female members; female retirees and so forth.

Rest is the most popular fund for women with more than 1.1 million women among its total 1.8 million membership; it is the most popular super fund for young women aged 34 or less.

"Aware Super is the most popular super fund for retired women, being women aged over 65. Aware Super also has the most funds under management owned by women and the most FUM owned by retired women," Rainmaker research manager Pooja Antil said.

Super funds with significant proportions of women leadership are: Aware Super, BUSSQ MySuper, CareSuper, Commonwealth Superannuation Corporation, Energy Super, HESTA, Media Super, NGS Super Accumulation, TASPLAN and Telstra Super.

Women hold $1.2 trillion of FUM out of the nearly $3 trillion asset pool (based on June 2020 figures).

AustralianSuper (957k), HESTA (708k), Aware Super (699k) and Hostplus (668k) make up the top five funds with the highest number of female members.

Women make up 50% of millennials yet own just 42% of the super millennials have accumulated; women comprise 53% of retirees yet own just 44% of all the superannuation retirees have accumulated.

"It doesn't mean women are denied a right to share in Australia's superannuation wealth, it's just that as a group they face bigger obstacles than men to get that share. But they're fighting back," Antil said.

Rainmaker executive director of research Alex Dunnin pointed out that just because a fund has a high proportion of female members doesn't make it a good fund for women.

"To be a good fund for women, a fund first needs to be a good fund. But having lots of women members makes the fund aware and it's a really good start," he said.

"For fund members, the implication of this is simple: one of the best signs that you're in a good super fund is that it has a high proportion of women in its leadership team. Another implication is if women are so good leading super funds, why aren't there more doing it?

"For women to have made it to this level of corporate leadership means they have to be tough, resilient, smart and accomplished."

Many of the leading funds most often used by women are those that support industries they dominate like health, education, retail, hospitality and the public sector.

Based on percentages, Guild Super has the highest share of women members at 85%; Australian Defence Force Super has the highest share of young women members (91%); while Challenger has the highest share of retired women of 84%.

In 2020, Rainmaker found funds with female trustees and leaders can boost a member's super by $100,000 over their working life.

The research house found funds with above-average female trustees and either a female chair or chief executive outperformed their male-dominated peers by 0.6% per annum over three years, and 0.4% per annum over five years.

Although this may not sound like much, for millennials and generation X, being with one of these female-dominated super funds over their working life can net them an extra $100,000.

This article first appeared on Financial Standard

Get stories like this in our newsletters.