Half of Aussies haven't checked their credit score - here's why they need to

By Geri Cremin

One in two Australians have never checked their credit report, but recent changes mean that understanding the reporting system is more important than ever.

What is credit reporting?

Most Australians have a credit report but most have also never checked to see what's in it. If you've ever borrowed money from a bank, taken out a plan with a mobile phone company, or signed up to an electricity account then chances are you have a credit report.

These companies pool information through credit reporting bodies so that next time you apply for credit a new service provider will have some awareness of any other debt you might have.

The system went through big changes in 2014, when comprehensive credit reporting was introduced.

Previously, credit reports had very limited information, including whether you'd applied for credit, and so-called negative behaviour such as payment defaults or becoming bankrupt.

Comprehensive credit reporting means lenders now report more information about customers' behaviour including positive information showing whether you've made your loan repayments on time. Comprehensive reporting also means more details about your credit accounts, such as the date an account was opened or closed, the type of credit and the limit.

Currently, around 95% of consumer credit accounts, such as home loans, credit cards or personal loans, have comprehensive credit reporting information being reported by nearly 60 financial institutions.

This is good news for customers; comprehensive credit reporting information paints a better picture of your credit history for lenders to better match their products to meet your needs.

Your report shows your credit health

When you apply for a loan, a lender may look at your credit report to see how healthy it is.

The report gives them a detailed record of your credit history so they get a better understanding of your debt commitments and whether you've made your payments on time. This gives credit providers an idea about how you manage loans and debts.

With this in mind, it's a good idea to understand your credit report as a picture of your credit health. CreditSmart research shows that 52% of Australians have never checked their credit report, and 22% don't know what type of information is included in such a report.

It is crucial you understand where to access your credit report, what information is included, and what it all means.

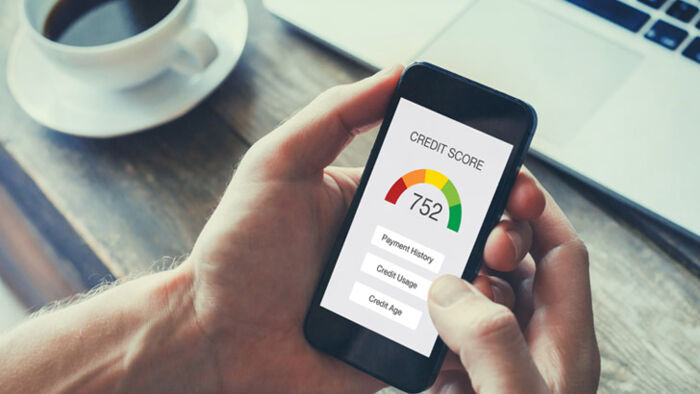

You have a right to a free credit report every three months from any of the credit reporting bodies. As well as information about your individual loans and repayment history, your credit report now also includes a credit rating (e.g. below average, average, good, etc) which is an indication of how you rate relative to others. The rating is based on the credit score calculated by the reporting body.

Your credit score summarises the information in your credit report into a single number, and may change each month depending on whether you make your account and loan repayments on time.

While a credit score can be a good indicator of whether someone is credit-worthy or not, most lenders will want to get behind the number and see the detail.

The credit score also doesn't tell the lender whether you can afford to repay the loan by comparing your current income against your loan repayment and other spending commitments.

Staying credit healthy

Life's big moments are often driven by the ability to get the credit you need, when you need it. How much you can borrow, and what interest rate you will pay, depends on your credit health.

There are several things you can do to take charge of your credit report.

A good repayment history will look good to lenders. Comprehensive credit reporting means lenders can see that you have made your loan repayments on time. Don't be too concerned if you miss the occasional repayment by a few days, but if you are struggling to make repayments, talk to your lender.

Having too many credit accounts is not a good look, but lenders also look at how many credit accounts you have applied for - regardless of whether you got those loans or not.

When you apply for a loan, the lender will make an enquiry on your credit report which is then noted on that report. If you have made a lot of enquiries (successful or not) within a short period of time, a lender may question why you are seeking so much credit and whether you are overextending yourself.

The golden rule is not to borrow more than you can handle, so make sure you only borrow what you need and can pay back.

Be conscious of other repayment obligations - if you are using buy now, pay later products, make sure you can afford to have those repayments leave your bank account without missing other

You can check your credit report for free every three months from the three credit reporting bodies, Equifax, and Experian and illion.

Get stories like this in our newsletters.