The ETF that lets you invest in Elvis royalties

By Nicola Field

$1 billion to be spent on dads this Father's Day, ASIC sets its sights on 'free' brokerage, and a chance to tap into the King's royalties. Here are five things you may have missed this week.

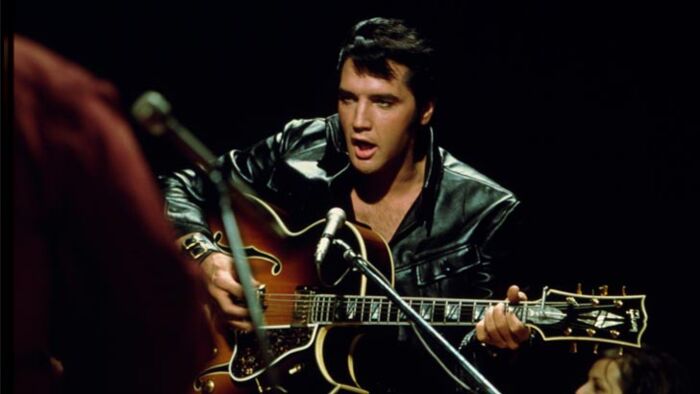

Stake a claim on The King's income

Many music lovers regard Elvis Presley as the undisputed king of rock 'n' roll. And despite having passed away over 40 years ago, it's not just his songs that live on.

Presley's hits continue to earn royalties to the tune of about $US39 million ($AUD56.8 million) annually.

If royalties are always on your mind, a new exchange traded fund could get you all shook up.

BetaShares has flagged the upcoming launch of its Global Royalties ETF (ASX: ROYL).

The ETF is a world-first according to BetaShares, providing exposure to a portfolio of royalty companies across multiple sectors.

There's no denying that royalties can be a rich vein of wealth.

Australia's richest woman, Gina Rinehart, derived a substantial part of her personal fortune from iron ore royalties, while Forbes lists Michael Jackson and Prince as among the highest paid deceased musicians thanks to ongoing royalty income.

The BetaShares ETF will offer exposure to royalties in the mining and pharmaceutical sectors as well as royalties from the back catalogues of artists such as Sting, David Bowie, Bob Dylan and of course, Elvis Presley.

2045: Save the date

The latest Financy Women's Index shows it will take 23.4 years for women to achieve pay equality with men.

At that rate, women can expect to earn equal pay by about 2045. Something to look forward to.

The Workplace Gender Equality Agency says the gender pay gap currently stands at 14.1%, up 0.3% over the last six months.

It means men earn an average of $263.90 more each week than women.

WGEA Director Mary Wooldridge says, "As a result of the gender pay gap, many Australian women have to work harder to make ends meet with very little room for discretionary spending or saving once they've covered the cost of daily essentials."

Equal pay for women is on the agenda at this week's Jobs and Skills Summit.

Father's Day spending tops $1 billion

As dads around the nation prepared to be pampered this Sunday, a Finder survey shows Australians will collectively spend around $1 billion on Father's Day - an average of about $108 per dad.

It turns out sons are more generous, with plans to spend an average of $124 on Father's Day gifts compared to $91 by daughters.

The three most popular gifts include clothing (socks and jocks we're guessing), followed by a meal out and something for dad's home or car.

For families who are strapped for cash, it can pay to follow the lead of 6% of Aussies, and give Dad a homemade present.

ASIC puts free and low cost trades on notice

Corporate regulator ASIC is warning online brokers to reconsider offering 'zero' or 'low-cost' brokerage, where the true cost to the consumer is masked.

Overseas share trading platforms such as Robinhood have long offered zero brokerage, and a number of local platforms have based their business models on the US disruptor.

But in the financial world there's no such thing as a free lunch.

'Zero' broking deals can hit investors' hip pockets in other ways. This may be through spreads on trades (the difference between buy and sell prices), or by charging cash management fees.

ASIC Commissioner Danielle Press says, "We strongly encourage retail investors to carefully consider what they are signing up for and make sure they understand the potential risks".

The regulator is also reminding brokers that the law prohibits conduct that is likely to "mislead or deceive" in relation to financial products or services, and is cautioning brokers that claim to offer zero or low-cost brokerage to carefully consider whether they may be in breach of the law.

Brighten launches home loans for expats

Non-bank lender - Brighten Home Loans, has launched Brighten Elevate, a new home loan product catering to expats.

Australia's relatively strong economy has seen a 116% surge in long term non-residents returning to Australia over the 12 months to June 2022 according to the Australian Bureau of Statistics.

But at any given time around one million Australians are living and working overseas. Despite many earning a high income, these expats can find it difficult to secure a home loan to buy property in Australia, often because salaries are paid in a foreign currency by an overseas employer.

Brighten is bridging the gap, with a home loan pitched at expats.

Brighten Head of Distribution Natalie Sheehan says the new loan product - Brighten Elevate, is suited to executives moving back to Australia, new migrant families of young professionals, and expats working overseas. The loan rate starts at 4.68%.

Get stories like this in our newsletters.